Could Your Business Face Fines for Pension Non-Compliance? Find Out!

In the UK, employers have a legal obligation to provide workplace pensions for eligible employees under the automatic enrolment scheme. Since its introduction in 2012, auto-enrolment has ensured millions of workers save for retirement. But as with any legal requirement, non-compliance can result in significant consequences for businesses.

If your business is not adhering to pension regulations, you could face hefty fines, reputational damage, and other legal complications. Here’s what you need to know about pension compliance, potential penalties, and how to avoid falling foul of the rules.

Understanding Pension Auto-Enrolment Requirements

Auto-enrolment is the process by which employers must set up a workplace pension scheme and automatically enroll eligible employees into it. This includes:

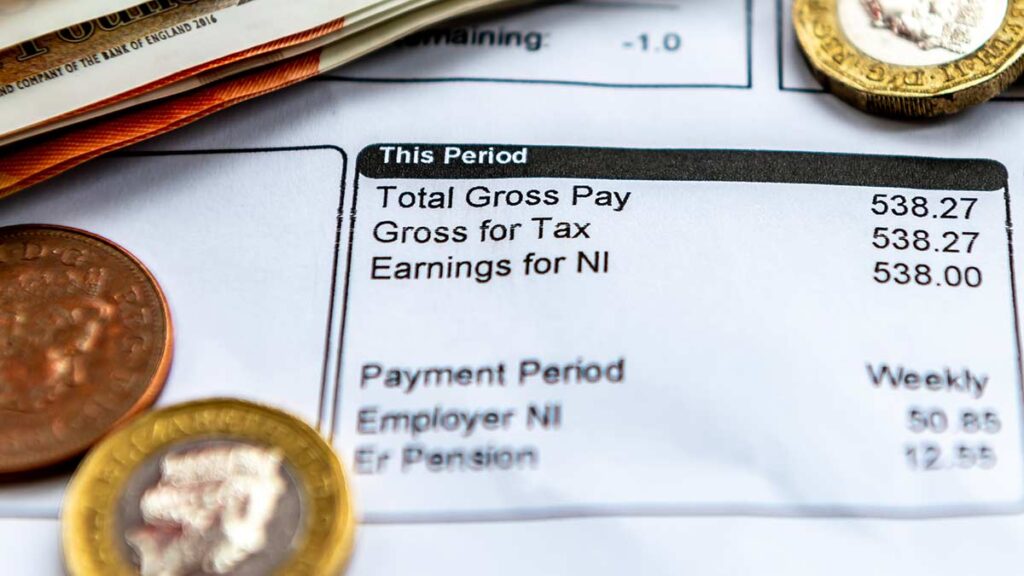

- Eligibility criteria: Employees aged between 22 and state pension age, earning at least £10,000 annually, and working in the UK.

- Employer contributions: Currently, the minimum total contribution to a workplace pension is 8% of an employee’s qualifying earnings. Of this, employers must contribute at least 3%, with employees making up the remainder.

- Assessment and enrolment: Employers must assess their workforce and enrol all eligible employees into the scheme, keeping records of compliance.

- Ongoing responsibilities: This isn’t a one-off task. Employers need to continuously assess eligibility and calculate pension contributions (e.g., for new hires, leavers, salary changes… ) and manage contributions regularly.

Failing to meet these requirements could lead to penalties and enforcement action from The Pensions Regulator (TPR).

Please note the following:

- If an employee is not eligible, they must still receive an official company communication and be given the right to opt in.

- Even if an employee wishes to opt out of the scheme and not contribute, they must first be enrolled in the scheme before opting out.

What Happens If You Fail to Comply?

The Pensions Regulator (TPR) is responsible for enforcing pension regulations and ensuring that businesses meet their duties. Non-compliance, whether deliberate or accidental, can lead to several penalties, including:

Compliance Notice

If TPR identifies that your business is not meeting its auto-enrolment duties, they may issue a compliance notice. This is often the first formal warning and gives you a deadline to resolve the issues. Failure to act could escalate the matter further.

Fixed Penalty Notice

If the compliance notice is ignored or insufficiently addressed, you may face a fixed penalty of £400. This is a one-off fine that serves as an immediate consequence for non-action.

Escalating Daily Penalty

Continued non-compliance could result in an escalating daily penalty, where the fine increases each day your business remains non-compliant. The amount depends on the size of your business:

- £50 per day for businesses with 1-4 staff.

- £500 per day for those with 5-49 staff.

- £2,500 per day for 50-249 employees.

- Larger employers could face fines of £10,000 per day.

Civil and Criminal Prosecution

Severe or intentional breaches, such as refusing to comply after multiple warnings, could lead to civil penalties of up to £5,000 for individuals and £50,000 for organisations. In extreme cases, criminal prosecution may be pursued, which could result in imprisonment or a criminal record for the responsible party.

How to Avoid Pension Non-Compliance

To avoid these significant penalties, businesses need to adopt a proactive approach to pension compliance. Here are key steps to ensure your business stays on the right side of the law:

Understand Your Duties

Make sure you’re fully aware of your obligations under auto-enrolment. This includes assessing the eligibility of your employees, setting up a suitable pension scheme, and contributing the minimum amount required.

Monitor Changes in the Law

Pension rules can change over time. Ensure you’re up to date with any changes to contribution rates, eligibility thresholds, or other regulatory updates from The Pensions Regulator. It’s essential to adjust your processes accordingly.

Use Pension Compliance Software

Invest in reliable workplace pension software that integrates with pension schemes. This will help you manage the workforce assessment and contribution calculations automatically and reduce the risk of human error.

Keep Accurate Records

TPR can ask to see records of your pension contributions, eligibility assessments, and statutory communications with employees. Keeping thorough records is essential for demonstrating compliance if your business is ever audited.

Communicate with Employees

Ensure that employees are aware of their pension rights. Provide clear information about their enrolment status, contribution rates, and opt-out rights. Regular communication can help avoid misunderstandings and unnecessary disputes.

Seek Professional Advice

If you’re unsure about your auto-enrolment duties, seek advice from a pension expert or adviser. These experts can ensure your business is fully compliant and help you avoid costly mistakes.

Why Choose Husky?

Staying compliant with pension regulations is crucial for any business, but it doesn’t have to be confusing or stressful. With Husky, compliance becomes straightforward. We work with employers across all sectors to ensure they meet their obligations and avoid costly penalties.

- Technology-Driven Solutions: Our innovative technology provides real-time assessments, proof of compliance, and alerts, ensuring your business is always up-to-date with pension regulations.

- Expert Support: Whether you’re facing compliance issues or just want peace of mind, our team of experts is here to guide you through the process.

- Proven Results: With over 2,000 satisfied clients and £50,000 saved in fines, Husky has a proven track record of delivering results.

Conclusion

Auto-enrolment compliance can seem overwhelming, but with Husky, it doesn’t have to be. Our technology and hands-on support ensure that your business remains compliant with pension regulations, reducing hassle, saving costs, and giving you peace of mind.

Don’t let pension compliance become a burden. Let Husky take care of it for you—so you can focus on what matters most: growing your business. Be compliant, not confused!

To learn more about how Husky can help your business, get in touch with us today.

Compliance made easy

Husky handles all auto-enrolment obligations, resolving any existing issues. With a track record of managing compliance for over 2,000 businesses, we’ve saved clients from over £50,000 in fines.

Related Post