Take control of your pension

The Husky for Everyone app makes it easy to get to grips with your workplace pension – and make sure you’re investing in what’s important to you. It’s simple to see how much you’re saving, what tax benefits you’re accruing and how your savings are invested and growing. (UK users only).

The Husky for Everyone app

- Cut through the complexity, so you truly understand your pension

- Get more visibility and control over your retirement planning

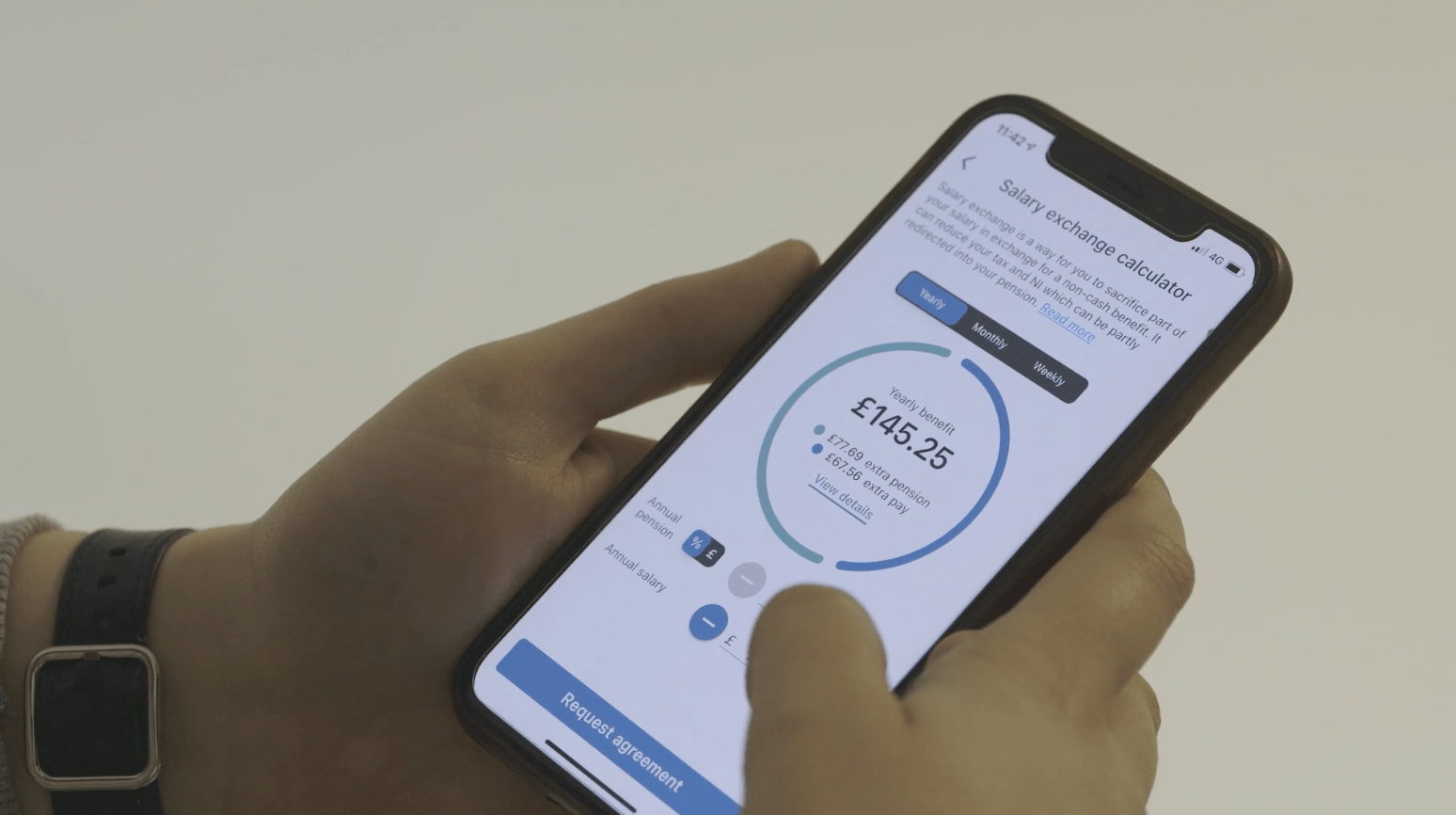

- Increase your take-home pay and your savings by utilising Salary Exchange

- Understanding how your savings are being responsibly invested

- Gain greater returns from the money you’re investing

Maximise Your Take-Home Pay

- Increase your net pay and boost your pension savings through salary exchange.

- Salary exchange is a straightforward change to how your employer deducts your pension contributions.

- Despite being available to almost everyone, only a small percentage of people utilize salary exchange due to the initial setup of their workplace pension scheme.

- Husky simplifies the process for your employer to offer salary exchange, handling all administrative tasks seamlessly for both you and them.

Supercharge your retirement savings

- Avoid high fees, save thousands over your working life.

- Husky offers better, lower-cost pension schemes, hassle-free for employers.

- Compare pensions easily with fee transparency.

- Benefit from exclusive preferential pricing through Husky, enabling you to save up to 80% on fees.

- Optimise your retirement funds, check your potential savings.

Secure your future with responsible investments

- Partnered with ethical investment specialist Impact Lens to provide independent and transparent scoring on pension scheme investments.

- Unique service that offers clear visibility on whether your funds align with your values.

- Utilize the Husky for Everyone app to easily monitor investments based on environmental, social, and governance standards.

- With a simple click, direct your savings into responsible schemes that reflect your values.

Talk to our dedicated customer support team.

- Kick off your onboarding call.

- We will set everything up for you and start administering the whole process.

- Reach out to real humans (we don't use bots) for help anytime via Email and Phone.

Our Achievements

80%

savings on pension fees with Husky’s exclusive preferential rates.

1700+

businesses have saved money, streamlined admin and ensured compliance with Husky.

10000+

individuals have more control over retirement planning because their employers use Husky.

£50,000+

We successfully resolved compliance issues for our clients, resulting in over £50,000 in fines avoided.

Award-winning solution

EXCELLENTTrustindex verifies that the original source of the review is Google. Professional responsive service that works for our business needs. Reliable, transparent, honest company to work with. Highly recommend.Trustindex verifies that the original source of the review is Google. My business, Spalding Massage Therapy used Husky's services throughout our period of employing staff. From set up and registering with HMRC through to sadly the point where we have had to stop employing, Husky and our point of contact Olga have been so helpful & professional. Their fees for small businesses are very reasonable IMHO and the Helpdesk has been relentlessly supportive - even when Olga had to explain the same thing to me 3 months running!Trustindex verifies that the original source of the review is Google. When time was of the essence Husky pulled our very new to the world of employment out of the waters. They were fast acting, professional and explained everything in a way that just melted all the anxiety of payroll and pensions away. The team are friendly and relatable, while being efficient and professional. We couldn't have asked for more, (a quick mention that Steve from payroll has been especially helpful and has gone above and beyond to explain any queries)Trustindex verifies that the original source of the review is Google. A very professional, efficient, trustworthy, reliable payroll and pension roll service provider that are competitively priced. Earl Shilton Town Council hope to have a long and happy working relationship with Husky Finance colleagues.Trustindex verifies that the original source of the review is Google. I would highly recommend Husky finance, I use them for Pensions on a number of our Companies. Kay is a superstar, she has helped me no end, a true professional throughout. Thank you Kay and all the team at Husky.Trustindex verifies that the original source of the review is Google. Excellent friendly service to sort all the statutory auto enrollment requirements in the UK for Erris Resources plc and Erris Gold Resources Ltd.Trustindex verifies that the original source of the review is Google. Husky manage both our monthly payroll and pension needs. From the beginning, they have been incredibly supportive. Our Head Office is in Ireland, so having a team knowledgeable of the intricacies of UK payroll and pensions has been a life saver for us.Trustindex verifies that the original source of the review is Google. Makes workplace pensions so much easier and transparentTrustindex verifies that the original source of the review is Google. We are certainly not their largest client, but they treat us so well and offer such great customer service, that you would think we were the most important client to them. Everything about working with Husky was so easy. We are a US based non profit hiring our first employee in the UK, so naturally, we had lots of questions. The team at Husky (especially Nigel and Kay) walked us through all of our options and really helped us find the best solution. I'd definitely recommend them.Trustindex verifies that the original source of the review is Google. We have used the services of Huskey for over a year now, they look after our company pension scheme. The reason I chose Huskey was because from the moment I contacted them they were so helpful and everything they promised, they followed through. Nothing was too much work for them. I would definitely recommend them.

Your next step

To access and use the Husky for Everyone app, your employer must sign up. This is because the app’s key features, such as integrating contribution information, enabling salary exchange, and assisting with scheme and fund selection, require coordination with your company’s pension administration. By joining the Husky platform, your employer can also benefit from cost savings, simplified administration, and crucial compliance management.

Here are the frequently asked questions

If you have more questions you can always access our knowledge base on this link.

Employers must automatically enrol all new and eligible employees who are:

- aged 22 to state pension age

- earning over £10,000 a year

- Working or ordinarily work in the UK

- Not already part of a qualifying workplace pension scheme

For Auto-Enrolment (AE) purposes, an employer only needs to assess and enrol UK workers into a scheme. Therefore, as an employer, you need to assess if a worker is working or ordinarily works in the UK under their contract.

Working in the UK: If a worker works wholly in the UK, then they can be considered to be working in the UK. By working wholly in the UK, The Pensions Regulator means:

- the worker’s contract provides for the worker to be based at a location in the UK, and the worker does, in practice, work all the time in the UK, and

- there is no simultaneous employment relationship between the worker and an employer outside the UK (e.g. the worker is not someone who has been sent to the UK by an affiliated employer, for example on a secondment.)

Ordinarily working in the UK: Where a worker is not wholly working in the UK (the work they do is also done outside of the UK), it will need to be established if the worker ordinarily works in the UK.

In most cases, workers who fall into this category will be workers who do not have one fixed workplace (for example, they move around in their work). To decide if a worker ordinarily works in the UK, an employer needs to consider:

- If the worker is resident in the UK

- where the worker begins and ends their work

- where the worker's headquarters in

- whether they pay NI and or tax in the UK

- the currency they are paid in

- the worker's contract of employment

- seconded workers

More details can be found here.

If you have a worker that should be exempt from AE due to not working in the UK, please enter that into Husky's system so that the worker is not assessed for Auto-Enrolment.

Before a private pension arrangement such as a SIPP can be in place, the AE process must first be followed with the worker being enrolled, if eligible, and then opting out.

Further, at the time of re-enrolment, the worker would need to be re-assessed and re-enrolled into a qualifying pension scheme if they meet the re-enrolment criteria, and then opt-out again before going into their present non-qualifying SIPP.

Anyone who became an employer after 1 October 2017 has to legally comply with automatic enrolment duties for their new employees.

These duties apply immediately from the first day the first member of staff started working for them. This date is known as the Duties Start Date.

When employees contribute to their pension scheme, they get tax relief on their contributions. This means that some of the employee’s pay, which would otherwise have gone to the government as tax, instead goes into their pension pot.

Tax relief on pension contributions may be given in two ways: “Net Pay” or “Relief at Source”:

Net Pay Scheme - Contributions are deducted from the employee’s gross salary (i.e. before tax has been deducted). This means that the employee automatically receives tax relief at his or her highest rate of income tax.

Relief at Source Scheme - Contributions are deducted from the employee’s net salary (i.e. after tax has been deducted). However, the employer deducts only 80% of the total contribution from the employee’s salary; the scheme then adds the basic rate tax relief amount (20%), which is claimed from HMRC by the pension provider.

Additional things to Note:

A pension scheme can only use one method for all members and this affects lower or higher paid staff in different ways:

- Employees who don't pay income tax only get the government top-up in relief at source schemes. If the scheme was on net pay, these employees won’t get tax relief and will have to pay 20% more for their pension.

Higher and additional rate taxpayers only get their full tax relief “up front” in a net pay scheme. If the scheme is a relief at source scheme, these members get only basic rate tax relief up front and need to reclaim the balance of their full tax relief (40% for higher rate taxpayers and 45% for additional rate taxpayers) by completing a self-assessment tax return (or writing to HMRC).

You can find more information tax relief like how it impact non-eligible employees, making claims for higher rate tax payers, and the aceess to its details within our Husky App here

From 6 April 2019 onwards, the minimum workplace pension contributions is a total of 8%, at least 3% of which must be paid by the employer.

These minimums are required by the auto-enrolment legislation. The employee must contribute 5% but they may reduce their contribution if the employer decides to contribute more than the minimum.

What is Re-Enrolment?

Every 3 years from their staging date or duties start date, employers need to re-assess workers who have previously Opted out or elected to leave the workplace pension more than 1 year from the re-enrolment date.

Any worker who meets the required assessment criteria for auto-enrolment then has to be re-enrolled in the pension scheme. These criteria are:

- age 22 up to the State Pension age

- earn at least £10,000 a year

- normally work in the UK (even if they often travel to other countries)

Once the re-enrolment process has been completed, a Re-Declaration of Compliance should be filed with The Pensions Regulator within 5 months of the third anniversary of the staging/duties start date, whether or not new staff were added to the scheme.

Employers need to complete the Re-Declaration once the re-enrolment process is completed. Husky will complete the Re-Declaration on the company's behalf.

When is Re-Enrolment happening?

Husky will apply the three-year anniversary of the staging date or the last re-enrolment date as your re-enrolment date. The pay period that contains this re-enrolment date will be assessed to determine any re-enrolment requirements.

You can select another date within three months from the re-enrolment date. Husky will contact you explaining the process and you can let us know if you would like to change your re-enrolment date.

What do you need to do?

Husky’s auto enrolment platform will apply the re-enrolment requirements and ensure all applicable workers are correctly assessed for re-enrolment. You may wish to advise any workers who have previously Opted Out of the scheme that they may be re-assessed, however, any worker that is to be re-enrolled will be issued with re-enrolment communication at the close of payroll. Your Payroll should also be advised that you will be applying re-enrolment on the date specified above.

If you have any queries please contact us at support@huskyfinance.com.

No. An employer must enrol all eligible employees first so that the pension provider can provide them with all the necessary information and documentation.

Only after being enrolled, employees can take the decision individually to opt out of the pension scheme.

If a worker opts out within a month of being added to the scheme, the payment will be refunded.

As an employer, you can contribute into your worker's personal pension instead of contributing into the company's workplace pension if you decide to do so. However, you have no legal obligation to pay employer contributions into a SIPP unless this is explicitly included as a change to the employment agreement (e.g. a side letter).

The simplest way for an employer to contribute into the SIPP is usually to set up a Direct Debit, but not all SIPPs might provide this option. It’s also worth being aware that some SIPP providers might not be able to deal with contributions varying (if the total salary varies).

See below the steps to follow if both employee and employer contributions want to be contributed to the worker’s personal pension scheme instead of the company’s Auto Enrolment one.

- First of all, the worker needs to opt-out from the company's AE scheme.

- The worker can then be moved to their own SIPP in Husky (You need to let Husky know the SIPP details and if the earnings basis and contribution levels are the same as the existing AE scheme).

- On a monthly basis, payroll will enter the salary and pension contributions into Husky as they do for any other employees. Those contributions will not be taken from the AE scheme as Husky will exclude this worker from the monthly upload into the pension provider.

- Instead, it's the employer's responsibility to manage those payments to the SIPP provider directly.

- During re-enrolment, the worker will need to be enrolled again into the company's AE scheme (Husky manages that process) and opt-out again.

In general, a seconded worker is one who is assigned from a foreign company to work for the local (UK) company for a limited period of time for a variety of reasons.

As far as the auto-enrolment [AE] regulation is concerned, we just need to confirm that the seconded worker's contract of employment is with the Indian company and that they will be going back to India after the work period (secondment period) has been completed.

If this is confirmed, then the UK company does not need to assess the seconded worker and auto-enrol him/her into the UK company's pension scheme.

The earnings basis refers to the basis of the employee’s earnings that are used for calculating pension contributions. See the options below:

- Qualifying Earnings:

- Total Minimum required: 8% of all Banded Earnings

- Company Minimum: 3% of all Banded Earnings

- Definition: All earnings between £520pm and £4,189 per month are the banded range

- All earnings include any of the following components: salary, commission, bonuses, overtime, maternity pay, statutory sick pay, etc.

- Pensionable Pay Set 1

- Total Minimum required: 9% of all Basic Earnings

- Company Minimum: 4% of all Basic Earnings

- Definition: Basic Salary used to calculate contributions. Excludes any additional earnings (i.e. bonuses, overtime, etc.)

- Pensionable Pay Set 2

- Total Minimum required: 8% of all Pensionable Earnings

- Company Minimum: 3% of all Pensionable Earnings

- Definition: Pensionable Earnings must be at least equal to basic pay and at least 85% of the total earnings (All earnings include bonuses, commission, overtime, etc.)

- Pensionable Pay Set 3

- Total Minimum required: 7% of all Pensionable Earnings

- Company Minimum: 3% of all Pensionable Earnings

- Definition: Pensionable pay includes all earnings (All earnings include basic salary, bonuses, commission, overtime, etc.)

Some workers who would normally meet the Auto-enrolment (AE) criteria may be exempt from AE if they have and can prove they have a Lifetime Allowance protection. This is because workers who have built up pension savings above the Lifetime Allowance for HMRC purposes are protected from tax charges on those savings.

Where an employer has reasonable grounds to believe that the member of staff has this protection (e.g. the worker has submitted some evidence), the employer can choose whether or not to put them into a pension scheme or to re-enrol that member of staff.

In order to get these protections, workers have to apply to HMRC. Therefore, workers will have documentation (a certificate) from HMRC detailing the type of protection from tax charges they have, which can be used as evidence.

If you have a worker that should be exempt from AE due to having a Lifetime Allowance protection, please enter that into Husky's system so that the worker is not assessed for Auto-Enrolment.

- Jon earns £5,000 a month and contributes 5% into his pension and his employer contributes 3%

- His monthly qualifying earnings would be £3,669.00 (£4,189 - £520)

- Therefore, his pension contributions will be calculated as 5% of £3,669 and his employer contributions will be calculated as 3% of £3,669

You can find more details on how your pension contributions are calculated by logging into the Husky for Everyone app.

Some workers who would normally meet the Auto-Enrolment (AE) criteria may be exempt or excluded from AE if they are Directors of a company.

A director is only a worker for AE purposes if:

- they have a contract of employment with the organisation

- at least one other person (who can be another director) also has a contract of employment with the organisation

Therefore, if a director has a contract of employment and is not the only person working for the company under an employment contract, they have AE duties.

Depending on their age and earnings, the Directors may qualify for AE. However, even if the Director qualifies, the company keeps the right to choose whether to enrol the Director into the scheme or not. The director would retain the right to opt into the scheme.

See more details here.

If you have a worker that shouldn't be enrolled on a scheme due to being a Director, please enter that into Husky's system so that no contributions are made.