Husky Blog

Gain some valuable insights on how to be compliant, improve your pension benefits, and become an employer of choice.

2025 Trends in Pension Management: Are You Prepared?

Pension management in the UK is evolving quickly, and now in 2025, it’s essential for businesses, accountants, and pension providers to stay ahead of the..

Salary Sacrifice: Transforming HR in 2025

As the workforce landscape continues to evolve, HR professionals face growing challenges to deliver benefits that are cost-effective, competitive, and engaging. Salary sacrifice—a tax-efficient method..

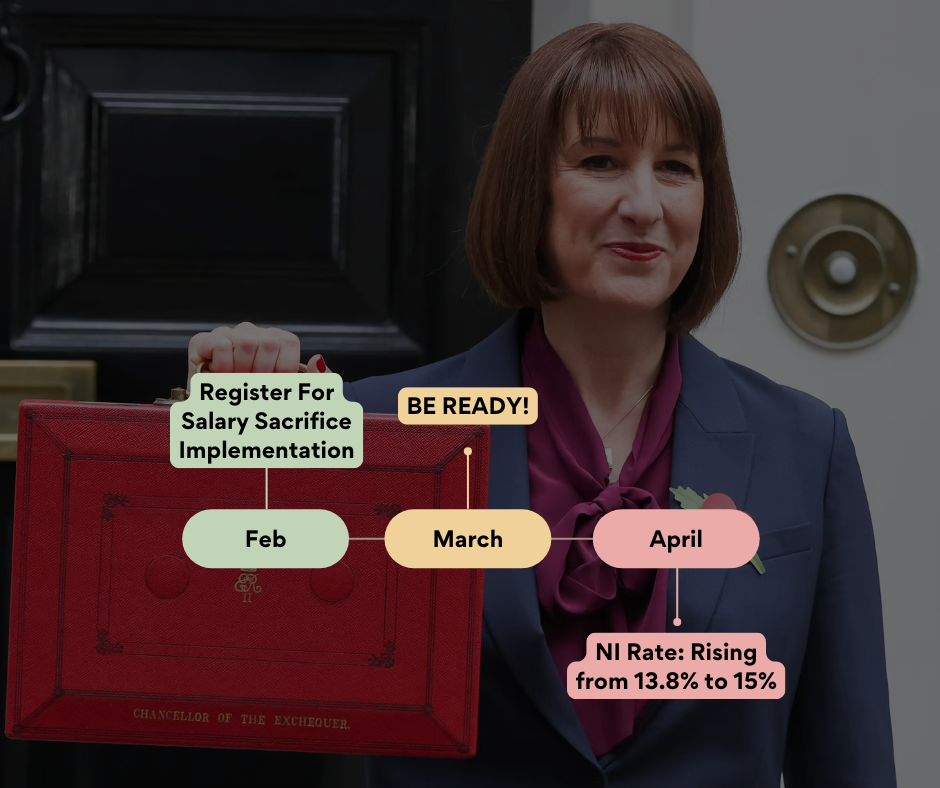

Be Ready: Higher Employer NI Rate in April 2025

With the Employer NI Rate set to rise from 13.8% to 15% in April 2025, alongside a lowered NI threshold, businesses face sharply increased payroll..

Why Director-Only Companies Should Consider Workplace Pensions

Workplace pensions aren’t just for employees – they can be a smart financial move for directors too. Even if auto-enrolment (AE) rules don’t require you..

Salary Exchange (Salary Sacrifice) For Employees

You can make your money work harder by using Salary Exchange to increase your take-home pay and grow your pension savings…