Navigating Pension Compliance: Insights from the Pensions Regulator

Ensuring compliance with pension duties is a critical responsibility for employers, yet navigating the complexities of regulatory requirements can be challenging. The Pensions Regulator (TPR) plays a vital role in overseeing pension schemes and enforcing compliance to safeguard the retirement savings of employees. Recent statistics published by the TPR shed light on the state of pension compliance among UK businesses, highlighting common errors and enforcement actions taken by the regulator.

Common Errors and Enforcement Actions

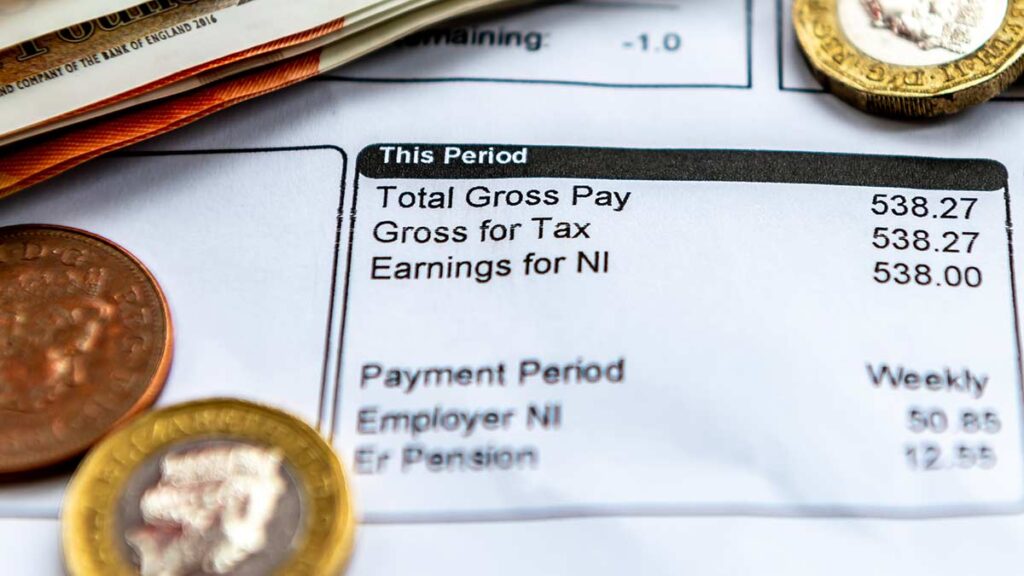

In a press release issued, the TPR highlighted common errors identified during its enforcement activities. The release coincided with the publication of the Compliance and Enforcement Bulletin. According to the bulletin, the TPR issued more than 50,000 notices during this period, indicating a significant level of non-compliance within the pension landscape.

Among the enforcement actions taken by the TPR, a notable aspect is the issuance of penalty notices to non-compliant employers. While the TPR mentioned some of the companies fined in its bulletin, the full extent of the fines can be estimated. Fixed penalty notices carry a standard fine of £400, while escalated fines average around £5,000 per case. By extrapolating the data provided by the TPR, the total fines issued during the six-month period amount to a staggering £35,710,800.

Implications for SMEs

The statistics provided by the TPR underscore the importance of pension compliance for businesses of all sizes, including small and medium-sized enterprises (SMEs). Despite the regulatory efforts to educate and support employers, a significant number continue to fall short of their pension duties.

A lot of SMEs have been notified of non-compliance by the TPR, signalling the widespread nature of the issue within this sector. This statistic serves as a powerful reminder for SMEs to prioritize pension compliance and seek assistance if needed to avoid penalties and safeguard their employees’ retirement savings.

How Husky Can Help

Navigating pension compliance can be complex, especially for small businesses with limited resources. Husky conducts real-time assessments during every pay run to provide proof of compliance. We appeal fines from The Pensions Regulator and resolve compliance issues to avoid penalties. We backdate contributions to quickly fix non-compliance issues and restore compliance.

By partnering with Husky, small businesses can navigate the complexities of pension compliance with confidence, ensuring the financial security of both their employees and their organisation. Visit our website to learn more about how Husky can support your business’s pension management needs in 2024 and beyond.

Compliance made easy

Husky handles all auto-enrolment obligations, resolving any existing issues. With a track record of managing compliance for over 2,000 businesses, we’ve saved clients from over £50,000 in fines.

Related Post