Understanding Payroll: Why Did My Net Pay Change?

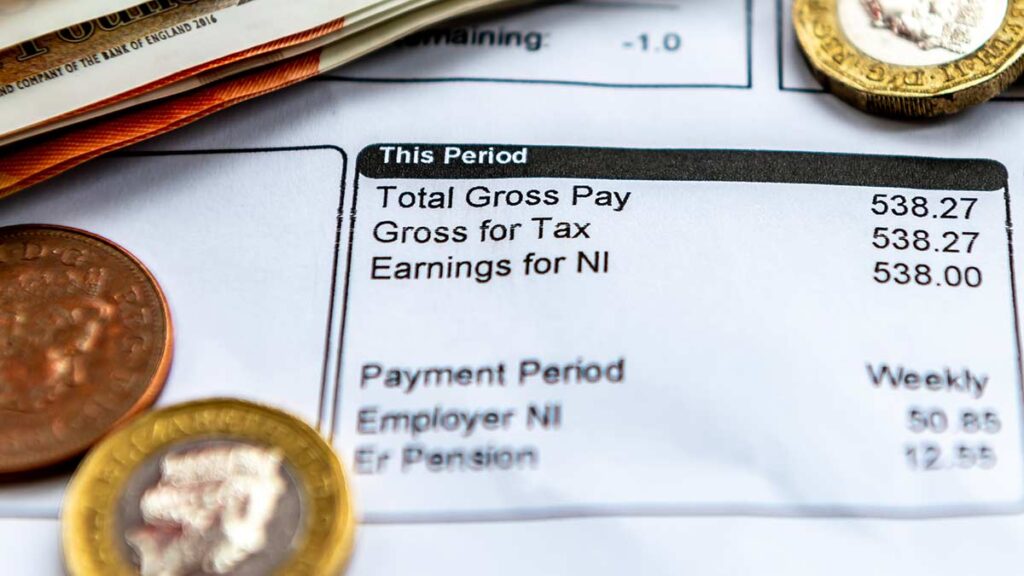

For many employees, changes in their net pay can be perplexing and sometimes concerning. Net pay, or the amount received after deductions and taxes have been subtracted from gross pay, can fluctuate due to various factors. Understanding why your net pay may have changed is essential for financial planning and peace of mind. Here are some common reasons why your net pay may have changed.

Tax Code Change

One of the most common reasons for fluctuations in net pay is a change in your tax code. Your tax code is used by your employer to determine how much income tax should be deducted from your pay. Changes to your tax code can occur for several reasons, such as changes in your personal circumstances, adjustments by HM Revenue & Customs (HMRC), or errors in previous tax calculations.

If your tax code changes, it can result in either more or less income tax being deducted from your pay, leading to a corresponding change in your net pay.

New Deductions

- Student Loan Repayments:

If you have a student loan, repayments may be deducted directly from your pay once you earn above a certain threshold. Changes to your student loan status, such as reaching a repayment threshold or entering a new repayment plan, can affect the amount deducted from your pay and consequently your net pay. - Benefits or Allowances:

Changes to your benefits or allowances, such as pension contributions, healthcare plans, or childcare vouchers, can affect your net pay. These deductions are typically agreed upon with your employer and are subtracted from your gross pay before calculating your net pay. - Other Deductions:

Additional deductions, such as court-ordered payments or union dues, can also impact your net pay if they are deducted directly from your salary.

Changes in Hours Worked or Overtime

Changes in Pension Contributions

Changes in National Insurance Contributions

Conclusion

Changes in net pay can be caused by various factors, including tax code changes, new deductions, changes in hours worked, pension contributions, and National Insurance contributions. Understanding why your net pay has changed is essential for financial planning and ensuring that your pay accurately reflects your earnings and deductions.

If you have any concerns or questions about changes in your net pay, it’s advisable to contact your employer’s payroll department or HR representative for clarification. Additionally, utilizing payroll services like those offered by Husky can provide expert support in managing your pay and ensuring accuracy and compliance with regulations.

Related Post