Your payslip is more than just a record of how much money you’ve earned—it’s a comprehensive breakdown of your pay, deductions, and contributions. Understanding the various components of your payslip is essential for financial literacy and can help you make informed decisions about your finances.

Here’s a guide to decoding your payslip and understanding the basics of payroll:

Gross Pay

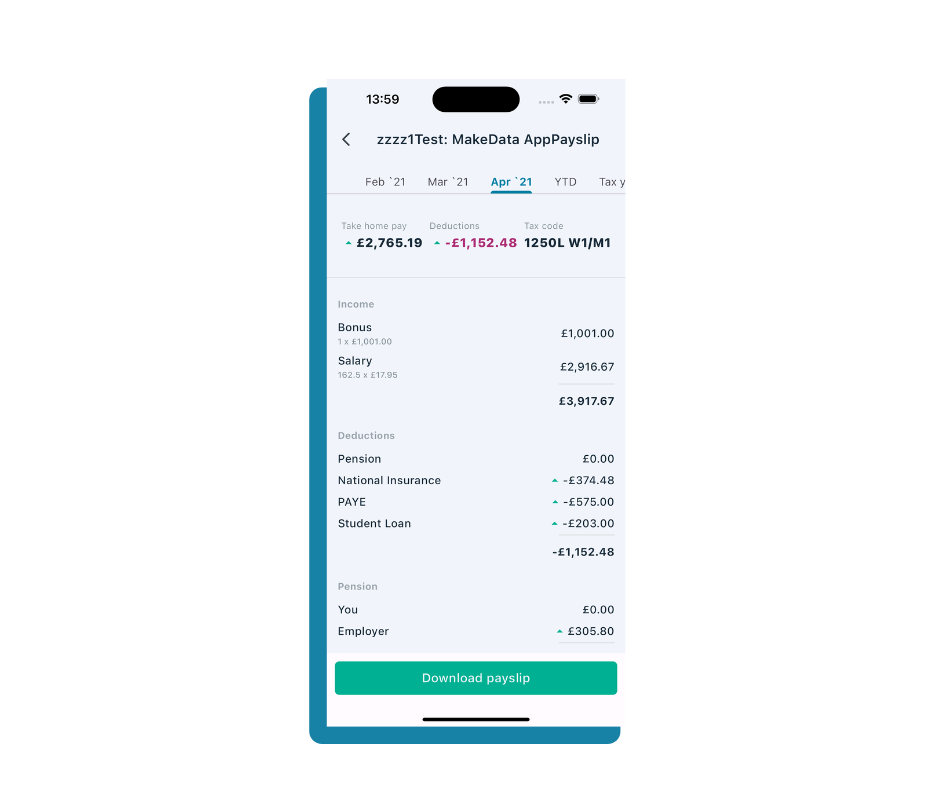

At the top of your payslip, you’ll typically find your gross pay. This is the total amount you’ve earned before any deductions or taxes have been taken out. It includes your regular salary or hourly wage, as well as any additional earnings such as overtime pay or bonuses.

PAYE (Pay As You Earn) Income Tax

PAYE refers to the system used by employers to deduct tax from employees’ pay before they receive it.

The amount of income tax you pay depends on how much you earn and your tax code. You can learn how tax is calculated here.

National Insurance Contributions (NICs)

National Insurance contributions are payments made by employees and employers to fund certain state benefits, including the state pension, unemployment benefits, and healthcare (NHS). There are different classes of NICs, but the most common for employees are Class 1 contributions. These are divided into two categories:

- Employee NICs: These are deducted from your gross pay and contribute to your entitlement to state benefits.

- Employer NICs: These are contributions made by your employer on top of your salary and are separate from your own NICs. Employer NICs are not deducted from your pay but are an additional cost to your employer.

Pension Contributions

If you contribute to a workplace pension scheme, your pension contributions will be detailed on your payslip. These contributions are deducted from your gross pay Contributing to a pension scheme is a tax-efficient way to save for retirement, as pension contributions receive tax relief.

Other Deductions

Your payslip may also include deductions for other purposes, such as student loan repayments or contributions to employee benefit schemes. These deductions will vary depending on your individual circumstances and agreements with your employer.

Net Pay

At the bottom of your payslip, you’ll find your net pay, also known as take-home pay. This is the amount of money you receive after all deductions and taxes have been subtracted from your gross pay. Your net pay is what you actually take home.

Conclusion

Your payslip provides valuable insight into your earnings, deductions, and contributions, helping you understand how much you earn and where your money goes. By familiarizing yourself with the various components of your payslip, you can better manage your finances and make informed decisions about budgeting, saving, and retirement planning. If you have any questions or concerns about your payslip, don’t hesitate to reach out to your employer’s payroll department or HR representative for clarification.

Husky runs payroll and making payslips easy in the app, see the app payslip below.