Your workplace pension partner

At Husky, we take the entire workplace pension burden off accountants

and payroll teams – saving time, reducing compliance risk, and helping

your clients save money.

- Save Time: Husky automates pension setup, uploads, communications, and compliance—no manual admin.

- One Platform: Manage all client schemes in a single portal—no multiple logins.

- Stay Compliant: Monthly compliance checks, audits, and auto-enrolment communications stored securely.

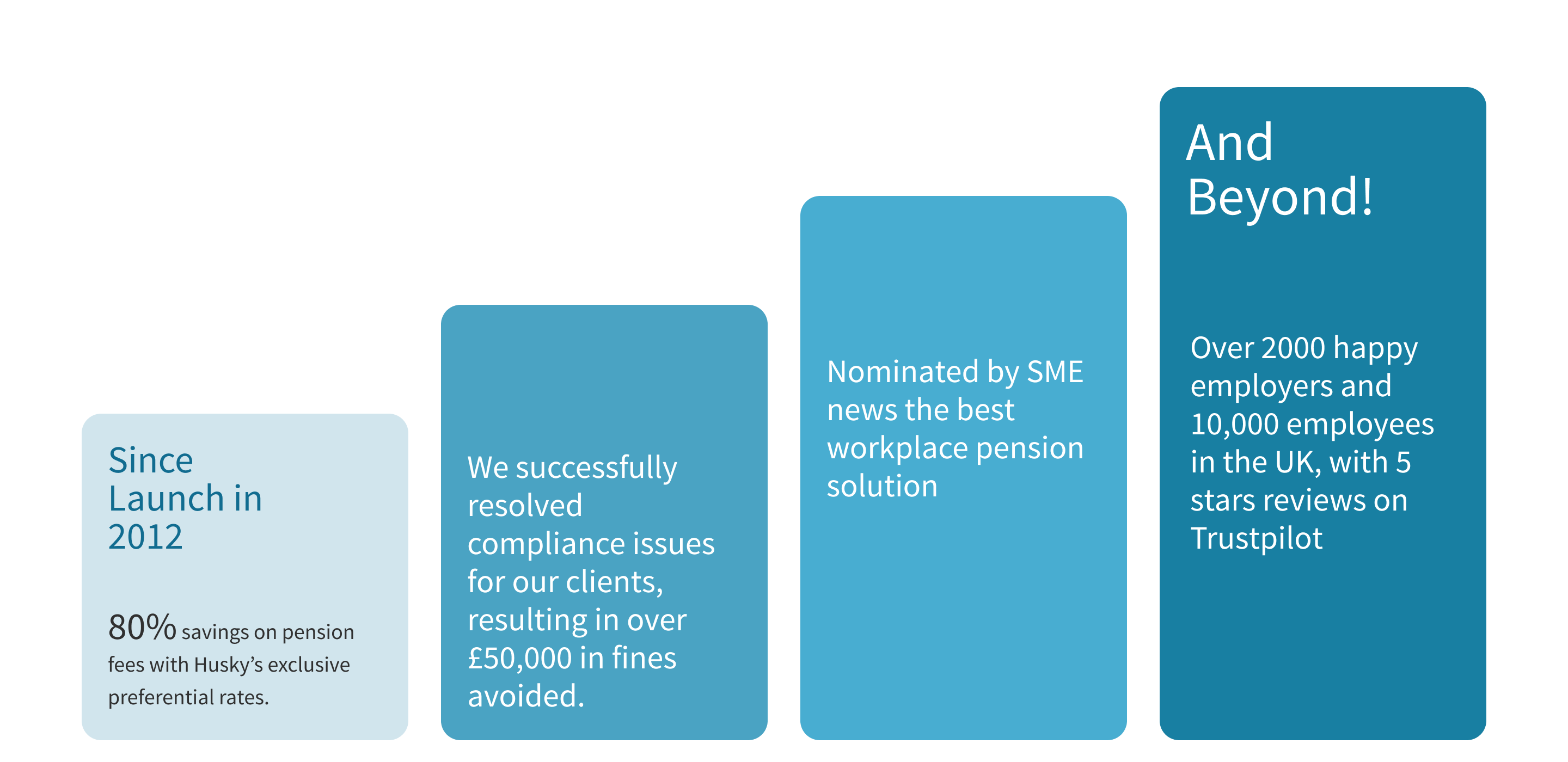

- Lower Costs: Access top providers at exclusive rates—save up to 80% on fees.

- Salary Exchange: Automates NI savings for employers and employees—boosts pay and cuts costs.

- Employee Engagement: App lets staff manage contributions and see pensions as part of their benefits.

Key Benefits for You

Over 2000 happy clients in the UK.

Partnership Options

We offer two flexible ways to work with us

-

You refer the client to Husky

-

The client contracts and pays Husky directly

-

You receive a commission or pass on a discount to your client

-

Husky’s platform is branded with your name and logo

-

You pay a discounted rate and bundle it into your service offering

Onboarding Journey

Salary Exchange Calculator

Over 2,000 employers save time and money with Husky.

EXCELLENTTrustindex verifies that the original source of the review is Google. Professional responsive service that works for our business needs. Reliable, transparent, honest company to work with. Highly recommend.Posted onTrustindex verifies that the original source of the review is Google. My business, Spalding Massage Therapy used Husky's services throughout our period of employing staff. From set up and registering with HMRC through to sadly the point where we have had to stop employing, Husky and our point of contact Olga have been so helpful & professional. Their fees for small businesses are very reasonable IMHO and the Helpdesk has been relentlessly supportive - even when Olga had to explain the same thing to me 3 months running!Posted onTrustindex verifies that the original source of the review is Google. When time was of the essence Husky pulled our very new to the world of employment out of the waters. They were fast acting, professional and explained everything in a way that just melted all the anxiety of payroll and pensions away. The team are friendly and relatable, while being efficient and professional. We couldn't have asked for more, (a quick mention that Steve from payroll has been especially helpful and has gone above and beyond to explain any queries)Posted onTrustindex verifies that the original source of the review is Google. A very professional, efficient, trustworthy, reliable payroll and pension roll service provider that are competitively priced. Earl Shilton Town Council hope to have a long and happy working relationship with Husky Finance colleagues.Posted onTrustindex verifies that the original source of the review is Google. I would highly recommend Husky finance, I use them for Pensions on a number of our Companies. Kay is a superstar, she has helped me no end, a true professional throughout. Thank you Kay and all the team at Husky.Posted onTrustindex verifies that the original source of the review is Google. Excellent friendly service to sort all the statutory auto enrollment requirements in the UK for Erris Resources plc and Erris Gold Resources Ltd.Posted onTrustindex verifies that the original source of the review is Google. Husky manage both our monthly payroll and pension needs. From the beginning, they have been incredibly supportive. Our Head Office is in Ireland, so having a team knowledgeable of the intricacies of UK payroll and pensions has been a life saver for us.Posted onTrustindex verifies that the original source of the review is Google. Makes workplace pensions so much easier and transparentPosted onTrustindex verifies that the original source of the review is Google. We are certainly not their largest client, but they treat us so well and offer such great customer service, that you would think we were the most important client to them. Everything about working with Husky was so easy. We are a US based non profit hiring our first employee in the UK, so naturally, we had lots of questions. The team at Husky (especially Nigel and Kay) walked us through all of our options and really helped us find the best solution. I'd definitely recommend them.Posted onTrustindex verifies that the original source of the review is Google. We have used the services of Huskey for over a year now, they look after our company pension scheme. The reason I chose Huskey was because from the moment I contacted them they were so helpful and everything they promised, they followed through. Nothing was too much work for them. I would definitely recommend them.

Watch the video

to learn more about Salary Exchange

Gain some valuable insights

Salary Sacrifice: Transforming HR in 2025

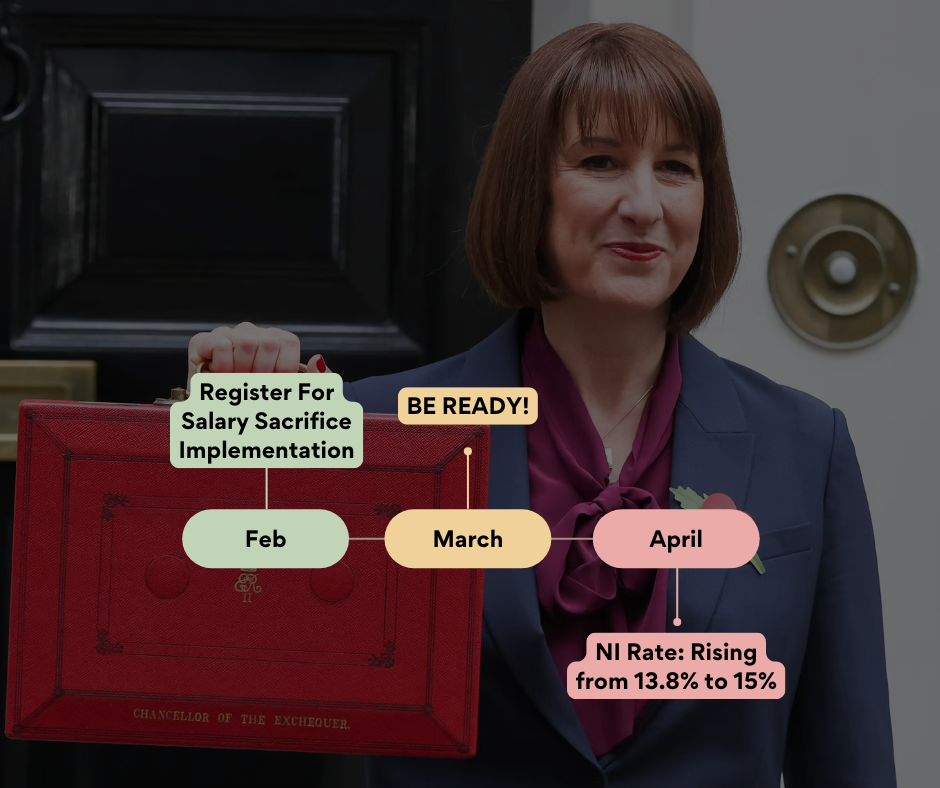

Be Ready: Higher Employer NI Rate in April 2025

Why Director-Only Companies Should Consider Workplace Pensions

Award-winning solution

Here are 7 frequently asked questions

If you have more questions you can always access our knowledge base on this link.

Employer NI savings

As the employee’s gross earnings are reduced, the employer also saves on their National Insurance Contributions (NIC).

Those savings can be re-invested into the employee’s workplace pension pot to provide an even better employee benefit and encourage them to join.

With Husky, you can also split those savings into specific %s so you can share the savings between the company and the employee.

Salary Exchange Guide

Salary Exchange is an agreement between the employee and the employer. The employee's contract of employment is altered to reflect that they have agreed to exchange part of their future gross salary or bonus entitlement in return for a non-cash benefit, such as an employer pension contribution.

What are the benefits of a Salary Exchange scheme?

- Employers save on NI contributions while employees can save on tax as well as NI contributions.

- Employers can reinvest any NIC savings in their business or their employees’ pension plans.

- Employees receive a higher pension contribution or take-home pay, depending on how the arrangement’s set up.

- Employees can benefit from a bigger retirement fund, if NIC savings are reinvested back into their plan.

Are there any possible drawbacks to a Salary Exchange scheme?

- Lower life cover (employers generally calculate entitlement as a multiple of salary which would be lower)

- Lower borrowing available on mortgages (as per life cover the borrowing level is determined by a multiple of a lower salary)

- Entitlement to state benefits eg Statutory Maternity Pay and the State Pension may be affected if your salary falls below the level at which you pay National Insurance contributions.

- The employee might not be able to revert to their old (pre-sacrifice) salary if personal circumstances change. The employer would have to agree to a further change to the employee's contract of employment.

Those savings can be re-invested into the employee’s workplace pension pot to provide an even better employee benefit and encourage them to join. With Husky, you can also split those savings into specific %s so you can share the savings between the company and the employee.

Can a salary exchange agreement be altered?

A salary exchange agreement can normally be altered, for example, if someone opts out of an automatic enrolment scheme with salary exchange.

For any other circumstances, it depends on how the agreement has been set up. It may be necessary to change the terms of a salary sacrifice arrangement where a lifestyle change significantly alters an employee’s financial circumstances.

This may include:

- changes to circumstances directly arising as a result of coronavirus (COVID-19)

- marriage

- divorce

- partner becoming redundant or pregnant

What are the benefits of a Salary Exchange scheme?

- Employers save on NI contributions while employees can save on tax as well as NI contributions.

- Employers can reinvest any NIC savings in their business or their employees’ pension plans.

- Employees receive a higher pension contribution or take-home pay, depending on how the arrangement’s set up.

- Employees can benefit from a bigger retirement fund, if NIC savings are reinvested back into their plan.

Are there any possible drawbacks to a Salary Exchange scheme?

- Lower life cover (employers generally calculate entitlement as a multiple of salary which would be lower)

- Lower borrowing available on mortgages (as per life cover the borrowing level is determined by a multiple of a lower salary)

- Entitlement to state benefits eg Statutory Maternity Pay and the State Pension may be affected if your salary falls below the level at which you pay National Insurance contributions.

- The employee might not be able to revert to their old (pre-sacrifice) salary if personal circumstances change. The employer would have to agree to a further change to the employee's contract of employment.

Those savings can be re-invested into the employee’s workplace pension pot to provide an even better employee benefit and encourage them to join. With Husky, you can also split those savings into specific %s so you can share the savings between the company and the employee.

Will Salary Exchange affect my current entitlement to Tax Credits?

You should speak to your tax credits office before you decide whether to participate in a Salary Exchange Scheme. You must also notify your tax credits office once you have exchanged your salary.

However, in broad terms, as your gross salary reduces (and employer pension contributions are disregarded) your entitlement to tax credits may increase. If you currently make personal contributions to a pension scheme, then you are currently entitled to deduct the gross amount of the pension contribution from your earnings to calculate your tax credits. In this situation, therefore, there should be little or no change to your tax credits entitlement.

Can Salary Exchange be used with existing pension plans?

Yes, salary exchange can be introduced into an existing plan as well as new plans.

How can one leave a salary exchange scheme?

Leaving a salary sacrifice exchange is always an option, and you should be able to do so without penalty if the arrangement isn’t working for you.

If a worker hasn't signed a Salary Exchange agreement, can they be automatically enrolled?

Joining salary exchange is an employee’s choice and therefore an employee can not be forced to opt into a salary exchange (salary sacrifice) scheme. Using salary exchange together with Auto-Enrolment means that if someone hasn’t signed the agreement they still need to be enrolled and therefore make their contributions as currently. As an employer, you can have two sets of employees: one set in the scheme without Salary Exchange and contributing normally and the second in the scheme with Salary Exchange where the contributions are all made from the employer. Some employers automatically include new employees in salary exchange (through their contract of employment) while allowing them to opt out of Salary Exchange if they wish.