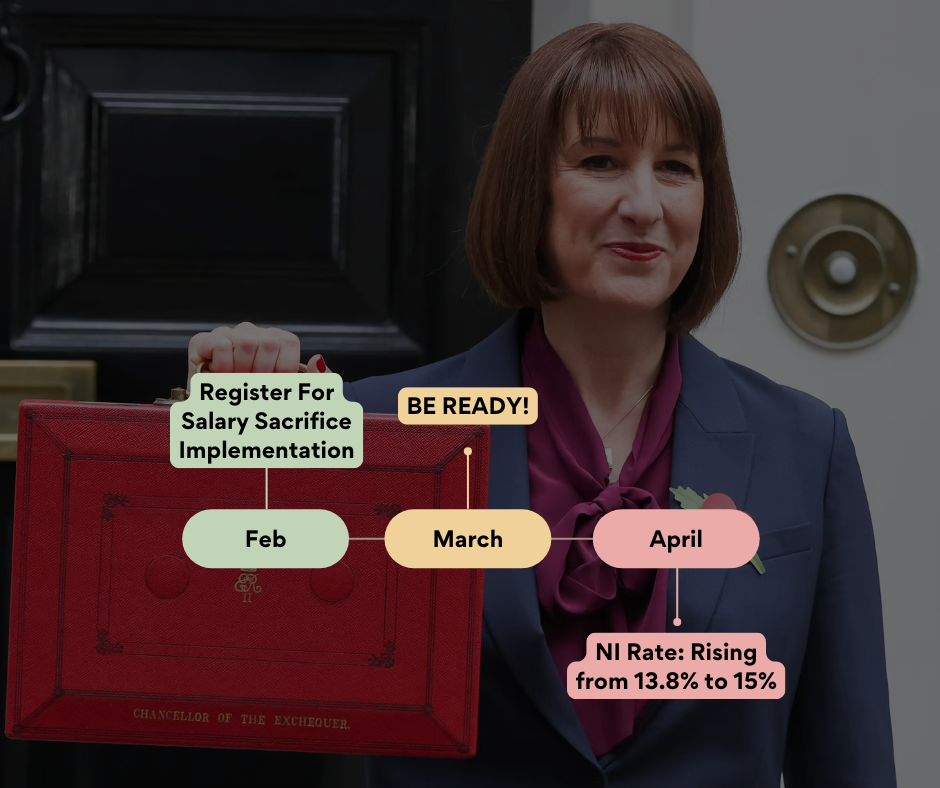

Be Ready: Higher Employer NI Rate in April 2025

With the Employer NI Rate set to rise from 13.8% to 15% in April 2025, alongside a lowered NI threshold, businesses face sharply increased payroll costs. Salary Exchange offers a clear, cost-saving solution to help employers navigate these changes while maintaining employee benefits.

The Impact of Budget 2024 Changes

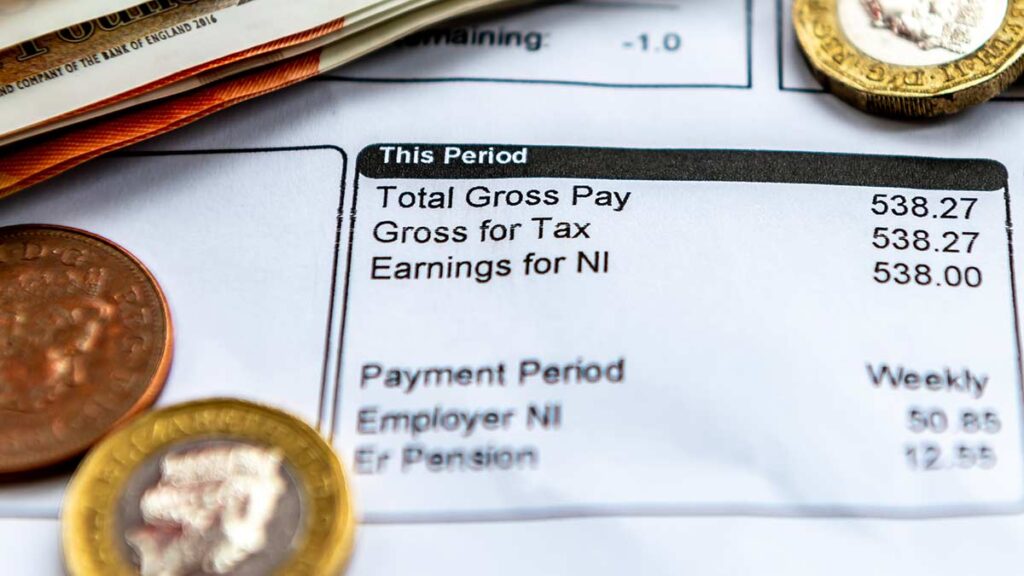

Key changes in 2025:

- Employer NI Rate Increase: Rising from 13.8% to 15%, significantly increasing payroll tax costs.

- Lower NI Threshold: Dropping from £9,100 to £5,000, subjecting more of your employees’ salaries to National Insurance.

- Increased Employment Allowance: Doubling from £5,000 to £10,500 to ease the burden on SMEs.

How Salary Exchange Transforms Costs

Salary Exchange reduces the gross salaries subject to National Insurance, delivering real savings for businesses. Brendan Shanks, CEO of Husky, explains:

“By adopting Salary Exchange, businesses can cut NI costs by nearly 90%, significantly easing the financial pressure from these reforms.”

Here’s a breakdown of the potential savings:

| Description | 2024/25 | 2025/26 |

|---|---|---|

| NI Threshold | £9,100 | £5,000 |

| Employer NI Rate | 13.8% | 15% |

| Annual NI Contributions | £35,742 | £45,000 (Increase of £9,258) |

| Allowance | £5,000 | £10,500 (Reduces cost by £5,500) |

| Business Cost | £3,758 | |

| Savings by Salary Exchange | £2,625 | |

| Total Business Cost | £1,133 |

Be Ready with Husky

Husky simplifies the process with automated Salary Exchange solutions:

- Husky’s automated process simplifies the Salary Exchange.

- Implementation, providing savings for both employees and the company.

- No administrative hassle.

- Husky ensures compliance.

Start Now

Don’t wait until April 2025. Future-proof your business and protect your employees’ financial well-being. Register to see how Husky can help you save time and money with Salary Exchange.

Related Post