Are you ready to claim your tax back?

Many UK employees are entitled to additional pension tax relief but never claim it. If you’re a higher-rate or additional-rate taxpayer, you could be missing out on up to 20% or 25% extra tax relief on your pension contributions.

This guide explains how pension tax relief works in the UK, who can claim more, and how to make sure you don’t miss out.

How pension tax relief works in the UK

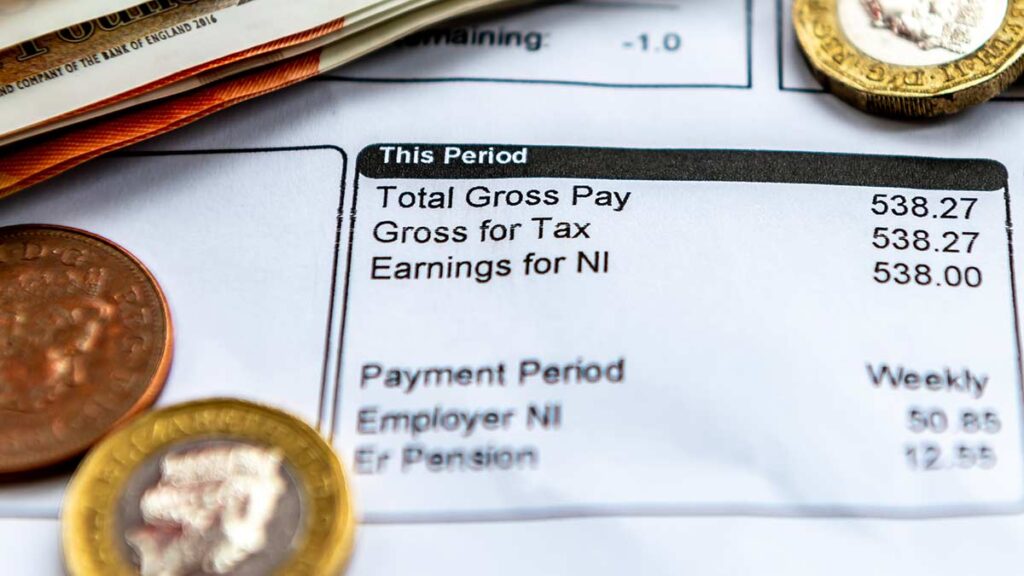

Most workplace pension schemes operate on a relief at source basis. This means your pension provider automatically claims basic rate tax relief (20%) from HMRC and adds it to your pension contributions.

However, if you pay tax at the higher rate (40%) or additional rate (45%), you may be entitled to extra pension tax relief above the basic rate.

This additional relief is claimed directly from HMRC and is paid back to you personally — either as a tax refund or an adjustment to your tax bill.

Who can claim additional pension tax relief?

You may be eligible to claim more tax relief if:

- You are a higher-rate or additional-rate taxpayer

- Your pension contributions are made under a relief at source arrangement

- You have not already claimed the full tax relief through your tax code or Self Assessment

Many people are eligible without realising it.

How to claim your additional pension tax relief

There are two main ways to claim:

- ThroughSelf Assessment

If you complete a Self Assessment tax return, include your pension contributions for the relevant tax year when submitting your return.

- By contacting HMRC directly

If you don’t normally submit a tax return, you can contact HMRC to request a tax adjustment or refund.

You can find step-by-step guidance on how and when to claim here:

👉 https://huskyfinance.com/when-do-i-have-to-claim-tax-relief/

HMRC deadlines apply, so it’s best to review your position as early as possible.

How Husky helps you track pension contributions

Using Husky to check your pension contributions

If your workplace pension is managed through Husky, you can easily view your pension contributions for each tax year in the Husky for Everyone app (available on Android and iOS).

Having accurate contribution figures makes claiming tax relief simpler and faster.

If you don’t yet have access, your employer or the Husky support team can help you get set up.

Important information

Husky provides workplace pension administration services but is not authorised to provide personal tax or financial advice.

This article is provided for general information only. If you’re unsure about your tax position, you should contact HMRC or speak to a qualified tax adviser.

In summary: don’t miss out on pension tax relief

If you’re a higher-rate taxpayer contributing to a pension under a relief at source scheme, you may be entitled to additional pension tax relief.

Checking your contributions and understanding how to claim could result in:

- Money back from HMRC

- A reduced tax bill

- Better visibility over your pension savings

It’s worth checking — even if you’ve never claimed before.

Get started

Register with Husky to get started or have a chat with our team to understand the benefits.

Related Post