Ask Your Boss About Salary Exchange

UK workers are missing out on savings

Are you working hard every day but missing out on a simple way to save more? Many UK workers are—because their employers haven’t set up Salary Exchange. But you can change that!

What’s Salary Exchange?

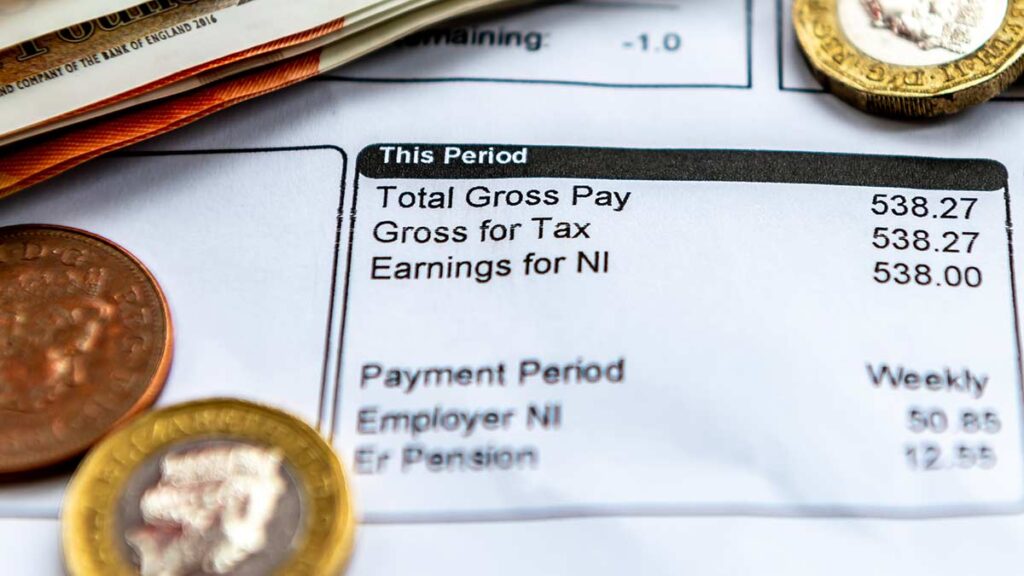

Salary Exchange (or Salary Sacrifice) lets you exchange part of your salary for benefits like extra pension contributions. This means you’ll pay less tax and National Insurance, so you keep more of your hard-earned money. Essentially, you’re contributing the same amount to your pension as before, but because you pay less tax, you end up with more take-home pay.

Discover John and his employer’s real-life savings journey Before the switch to Salary Exchange:

| Item | Default | After Exchange | Saved |

|---|---|---|---|

| Gross Salary | £35,000 | £33,562 | |

| Income Tax | -£4,486 | -£4,198 | |

| Employee NIC | -£2,692 | -£2,519 | |

| Take-home Net Pay | £26,672 | £26,844 | £173 |

| Employer NIC | £3,574 | £3,376 | £198 |

| Total Pension Contribution | £2,300 | £2,300 |

Summary of savings and benefits:

- John (Employee): Gains an extra £173 in take-home pay.

- Employer: Saves £198 in National Insurance and could potentially save more on corporation tax.

- Pension Contribution: Stays the same, or increases if the employer reinvests savings into John’s pension.

Why your boss probably hasn’t implemented it yet?

Often, small or medium businesses aren’t aware of Salary Exchange, or they think it’s complicated. But with Husky’s tech, it’s straightforward and cost-effective—and employers save on National Insurance too, with the latest Budget updates in the UK, now is the perfect time to explore it.

How to make this happen?

You have the power to start the conversation! Here’s how:

- Talk to HR or Payroll: A quick conversation about Salary Exchange could open doors to new savings.

- Use Our Free Calculator: See how much you and your employer could save with Salary Exchange—then bring these numbers to HR. [Try it here!]

- Get Colleagues Involved: More voices mean a stronger case for bringing Salary Exchange to your workplace.

We also prepared this email text so you can simply copy & paste and send out to your employer.

Subject: Exploring Salary Exchange Benefits

Hi [HR/Payroll Contact’s Name],

I hope you’re well. I recently came across an article on HuskyFinance.com discussing the benefits of a Salary Exchange scheme, especially in light of the recent Budget 2024 updates. With the new changes, it seems Salary Exchange could offer even more significant tax savings for both employees and the organisation, while also supporting long-term financial well-being.

Would it be possible to arrange a time to discuss this further? I’d love to hear your thoughts on whether this is something we could consider, given the recent updates.

Thank you for considering this suggestion!

Best wishes,

[Your Name]

[Your Position]

Act now. Don't wait.

Salary Exchange is an easy, tax-smart way to maximise your income for the future. And with both you and your employer saving, it’s a win-win.

Don’t wait—talk to your employer today and start keeping more of what you earn. Those extra savings can make a real difference down the line.

If you refer someone, we’ll give you a £50 Amazon voucher as a thank you!

Get more now. Have more later.

We setup and manage your pensions, payroll, and salary exchange—all in one place, ensuring compliance every step of the way.

Related Post