Increase net pay while saving more into your pension

Salary exchange is a simple change in the way your employer deducts your pension contributions. It allows you to have more money in your take-home pay and pension pot, at no cost to your employer. Nearly everyone has the right to salary exchange, but only a small percentage of people do because most employers find it too complicated to administer.

We unlock the benefits

of Salary Exchange

We discovered that over 95% of small businesses are not benefiting from the Salary Exchange scheme. We handle the setup and management for you, so you don’t miss out on this valuable benefit.

Why setting up Salary Exchange is so crucial?

It allows you and your employees to save on National Insurance contributions, putting more money in their pockets each month and increasing cash savings for your business.

In short, everyone wins.

Boost take-home pay now

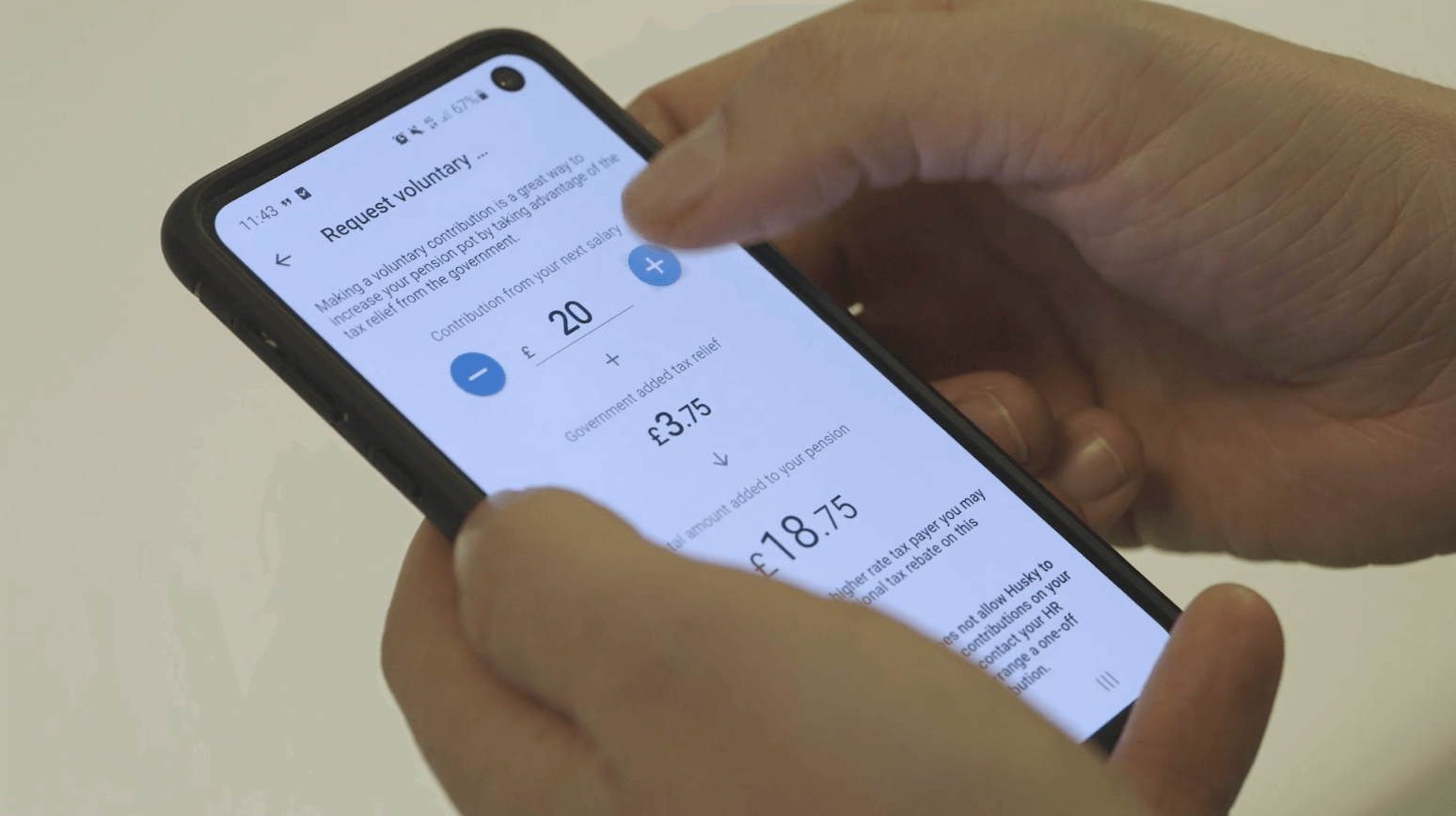

Normally, your pension contributions come out of your net pay – that is, after income tax and National Insurance are deducted. With salary exchange, your pension contributions come out before tax. This means your taxable gross income is lower, so you pay less National Insurance – giving you more take-home pay. Your employer also pays less National Insurance, and they can put that savings into your pension.

The benefits of salary exchange – in figures

Let’s look at an example.

John’s gross annual salary is £30,000. He and his employer pay the legal minimum into his pension. This means that, each year, John contributes £1,188 and his employer contributes £712.8, for a total of £1,900.80.

When John switches to salary exchange, he gets:

- £142.56 more in in his take-home pay

- £163.94 more in his pension pot

And it didn’t cost his employer a penny.

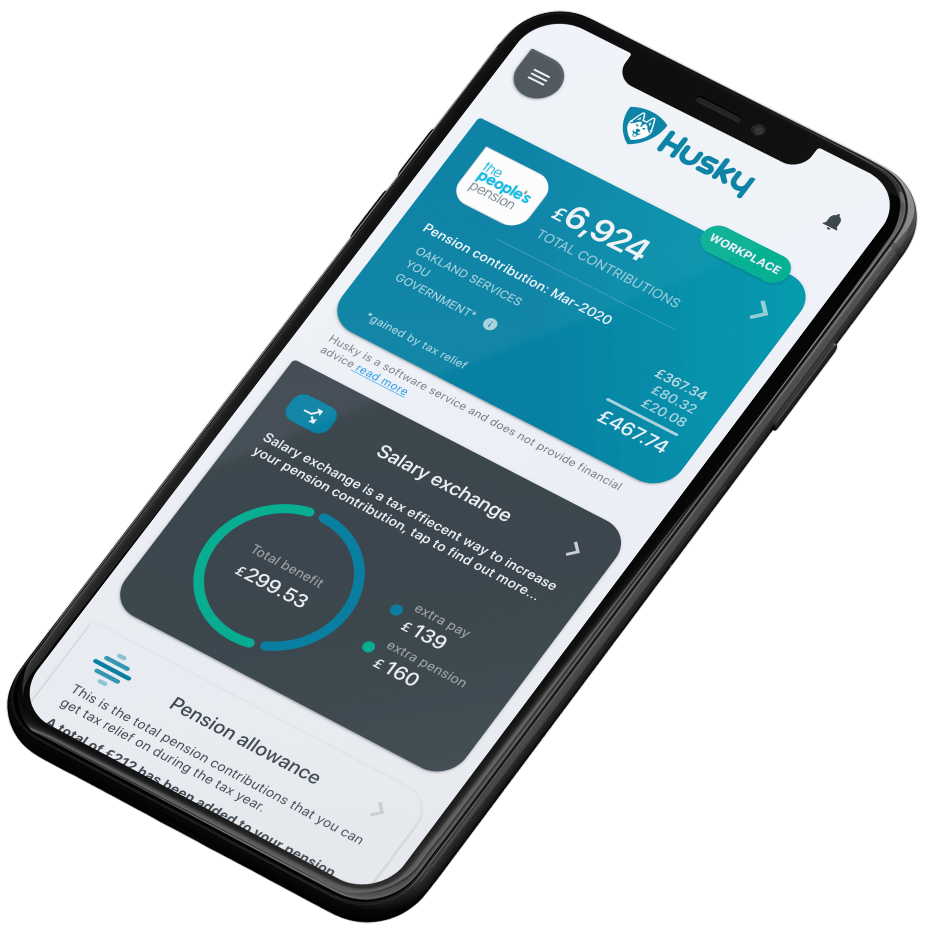

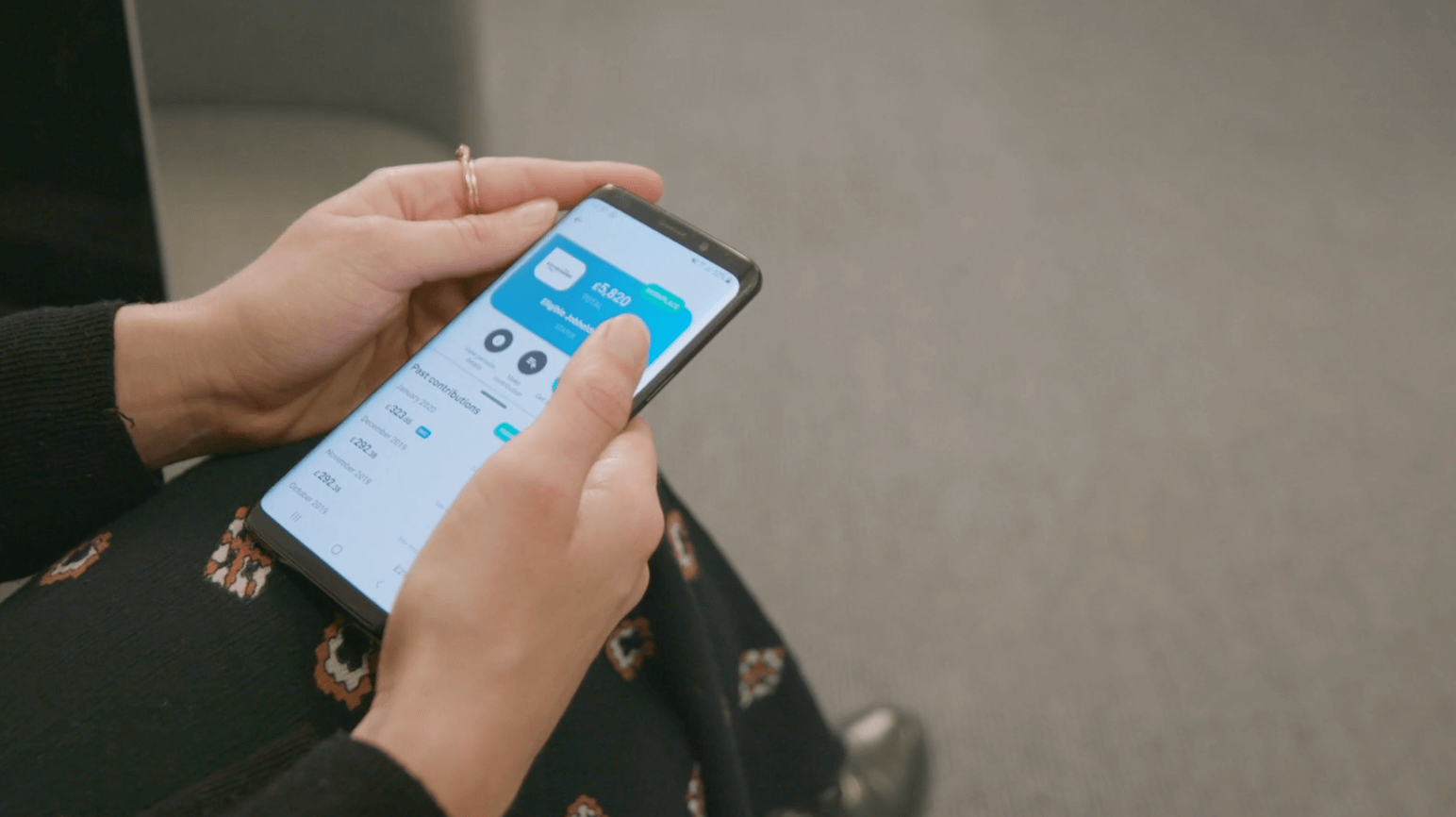

Have complete control with the Husky for Everyone app

- How much you are saving

- What tax benefits you’re accruing

- How your savings are invested

- How much you should be contributing based on your earnings and life stage

Talk to our dedicated customer support team.

- Kick off your onboarding call.

- We will set everything up for you and start administering the whole process.

- Reach out to real humans (we don't use bots) for help anytime via Email and Phone.

Our Achievements

80%

savings on pension fees with Husky’s exclusive preferential rates.

1700+

businesses have saved money, streamlined admin and ensured compliance with Husky.

10000+

individuals have more control over retirement planning because their employers use Husky.

Get more on your next payslip

Your employer has to set up salary exchange for you. The Husky salary exchange service makes the whole process easy, taking care of all the admin so it’s seamless for you and your company.

It works this way because key features – like pulling in your contribution information, setting up salary exchange and helping you choose schemes and funds – require coordination with how your company administers the workplace pension. Your employer gets a whole host of benefits through the Husky platform, too, from cost savings and admin simplicity to essential compliance management.