Taxassist In Banbury and Husky – working together to help you

You’re legally required to offer your employees a pension and re-enrol them at regular intervals. However, legislation is complex, and the penalties for non-compliance are hefty. That’s why Taxassist In Banbury has partnered with auto-enrolment specialists, Husky.

Husky delivers pension choice, gives you peace of mind you’re compliant, and frees up your time and resources. Our affordable service gives you tailored pension options and then handles all the ongoing admin and compliance – so you can focus on growing your business and serving your customers.

Is pension contribution mandatory in the UK?

Let’s start by explaining that whether you have 5,000 employees or just one, your pension scheme must be up and running within six weeks of their start date. Yes, you heard it right: Within six weeks from their start date.

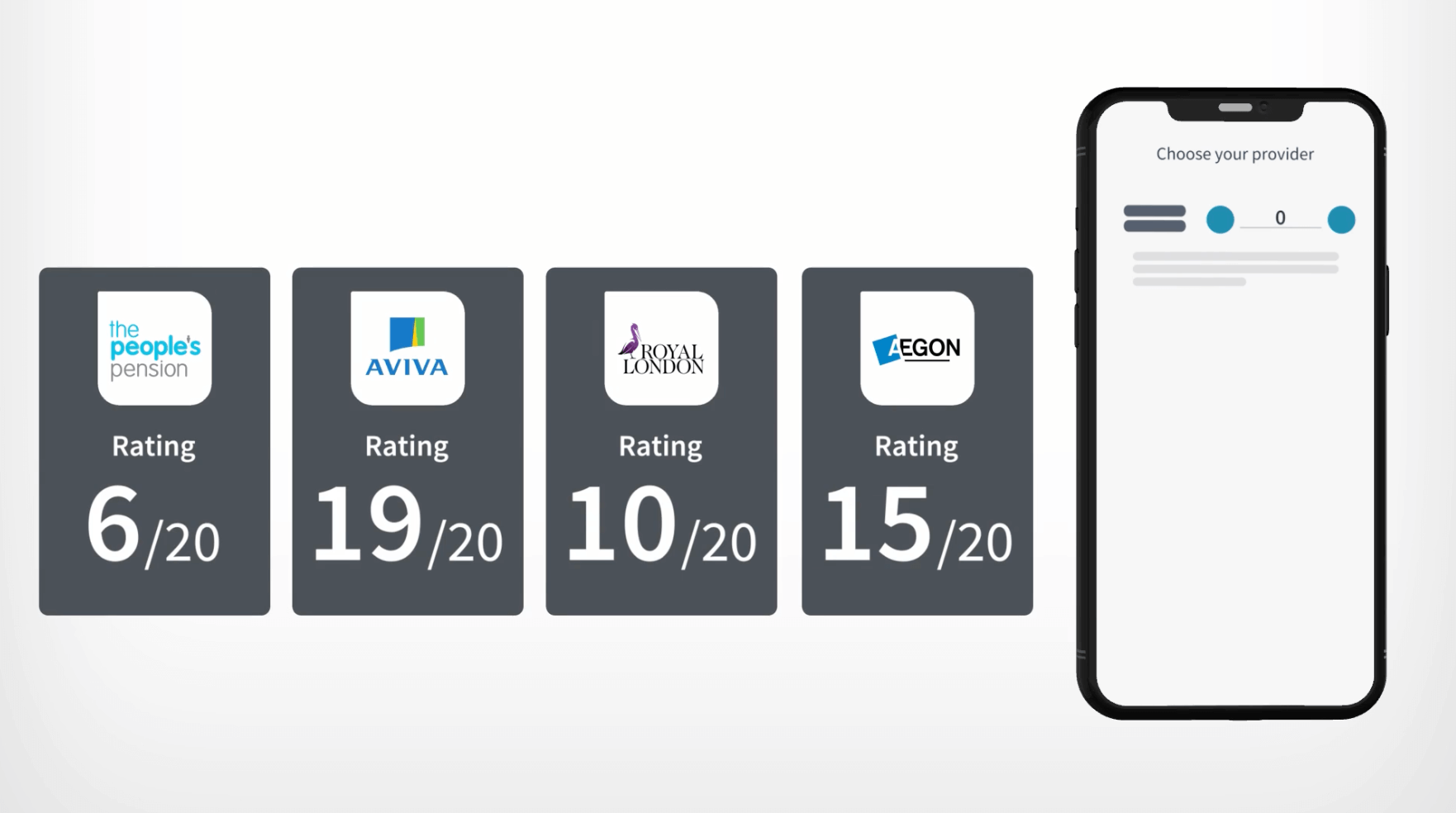

Guided pension scheme choice and setup

To start, we’ll provide the most affordable pension plan that suits your company’s needs. The reason we offer lower scheme costs is because we have partnered with multiple providers for preferential rates.

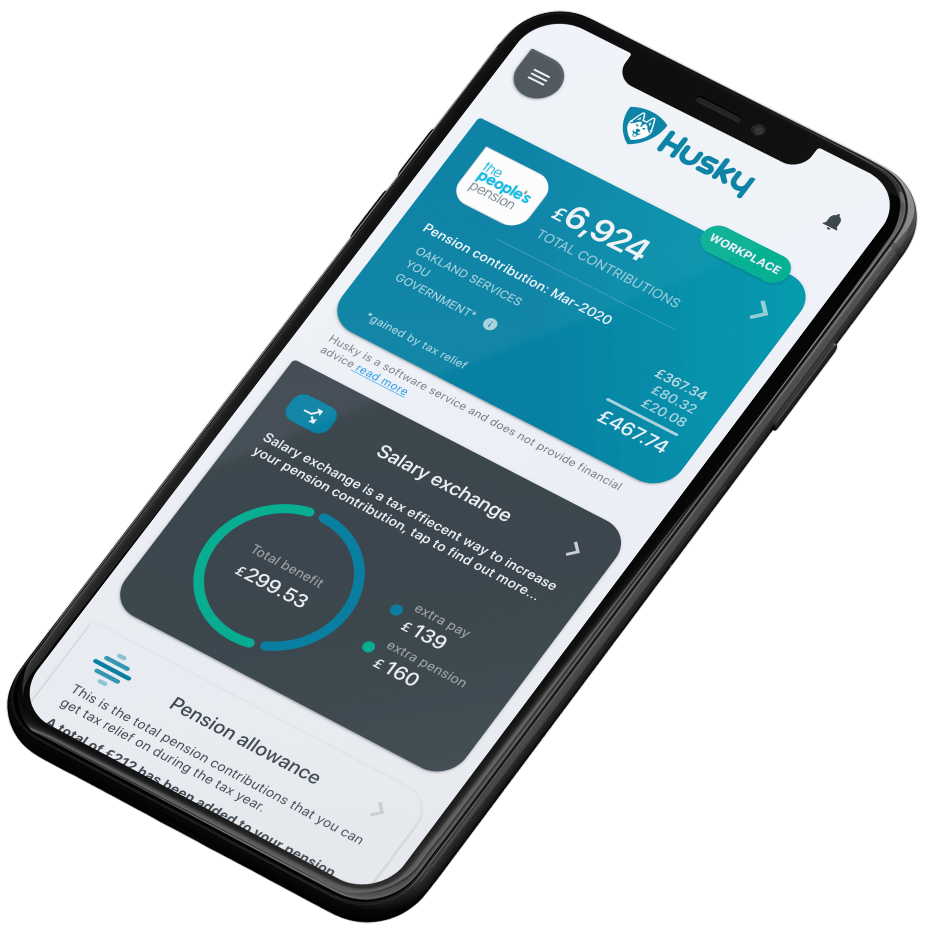

Husky for Everyone app

Empower your employees with the Husky for Everyone app to effortlessly monitor their retirement savings from anywhere. This app provides real-time pension information, including savings options, tax details, and notifications for important life events and earnings changes. It also enables easy connection with a financial adviser if desired.

We unlock the benefits

of Salary Exchange

We discovered that over 95% of small businesses are not benefiting from the Salary Exchange scheme. We handle the setup and management for you, so you don’t miss out on this valuable benefit.

Why setting up Salary Exchange is so crucial?

It allows you and your employees to save on National Insurance contributions, putting more money in their pockets each month and increasing cash savings for your business. In short, everyone wins.

Save time and money

The challenges

Imagine the amount of time and money you could save if all these issues were resolved.

Employers

Pension schemes can be challenging and complex to set up, presenting challenges in employee communication and posing a high risk of non-compliance with numerous providers.

Employees

Lack of control over pensions causes stress and disengagement. Difficulties in engaging with pension providers result in missed tax benefits from pension/salary exchange and a lack of access to financial advice.

Accountants

The burden of administration and lack of expertise in Auto Enrolment and Salary Exchange discourage many from offering these benefits. There is also a risk of accountability for non-compliance.

Advisors

The risk of accountability exists for non-compliance. Additionally, there is a lack of access to employee and workplace pensions data, along with the burden of administration for Auto Enrolment and Salary Exchange, resulting in missed potential.

See why employers

choose Husky.

Ben Spencer | Director of Westwon Fleet

John Ditchfield | Head of Responsible Investment, Helm Godfrey

Val Buzzard | Director of Whitley Stimpson

Our Achievements

80%

savings on pension fees with Husky’s exclusive preferential rates.

1700+

businesses have saved money, streamlined admin and ensured compliance with Husky.

10000+

individuals have more control over retirement planning because their employers use Husky.

£50,000+

We successfully resolved compliance issues for our clients, resulting in over £50,000 in fines avoided.