Salary Exchange (Salary Sacrifice) For Employees

You can make your money work harder by using Salary Exchange to increase your take-home pay and grow your pension savings.

What’s Salary Exchange?

Salary Exchange, also known as salary sacrifice, is a tax-efficient way to contribute to your pension plan. You give up part of your salary in exchange for a non-cash benefit from your employer, such as increased pension contributions.

You’ll see more in your pocket at the end of every month and potentially more on your pension pot.

The benefits

- Higher take-home pay as you pay less NI.

- Potentially more on your pension pot (if the employer re-invests some of their NI savings).

- High earners get tax relief immediately and do not have to manually claim it back.

To decide if salary exchange is right for you, consider the following:

- You can’t participate if reducing your salary brings it below the National Minimum Wage or National Living Wage.

- Salary exchange might also affect other benefits that are based on your gross salary.

- Leaving a salary exchange is always an option, and you should be able to do so without penalty if the arrangement isn’t working for you.

- Joining salary exchange is an employee’s choice and therefore an employee can not be forced to opt into a salary exchange (salary sacrifice) scheme.

Discover John and his employer's real-life savings journey

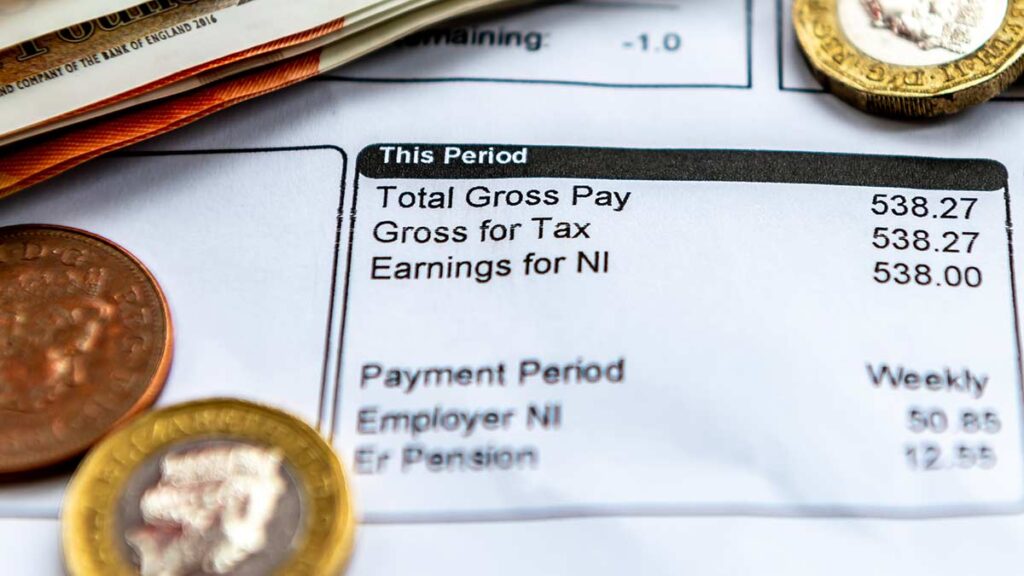

We used these parameters for the scenario below: 50k average salary – PPS1 – 5% employee contributions – 30 workers – 50% NI re-investment.

Sign up process

Everything is done through the app, you can track your benefits in real-time using the Husky for Everyone App.

Request

Request via app

Start saving

Start saving from the next payroll period

What do I need to take into account before applying for Salary Exchange?

Before applying for Salary Exchange, consider the following:

- Impact on Statutory Payments: Salary Exchange can affect entitlements such as statutory maternity, paternity, or sick pay, which are based on gross salary.

- Minimum Wage Compliance: Ensure that your new salary after the exchange doesn’t fall below the National Minimum Wage.

- Impact on Other Benefits: Check if it affects other benefits like overtime, bonuses, or life cover.

- Long-Term Commitment: Consider your long-term financial goals, especially if you are nearing retirement.

Can I exchange as much as I want?

No, there are limits to how much you can exchange:

- Minimum Salary Threshold: Your new salary after the exchange must not fall below the National Minimum Wage or National Living Wage.

- Pension Contribution Limits: Ensure you do not exceed the annual allowance for pension contributions (£60,000 for the 2024/25 tax year). If exceeded, it could result in tax charges.

- Company Policies: Some employers have caps on the percentage of salary that can be exchanged.

How does tax relief work with Salary Exchange?

Tax relief with Salary Exchange works as follows:

- The exchanged portion of your salary is deducted before tax is calculated, which reduces the amount of Income Tax and NI contributions you pay.

- For example, if you exchange £100 per month for pension contributions, you save Income Tax and NI on that amount, effectively increasing the value of your contribution.

Does salary exchange affect mortgage applications?

Yes, Salary Exchange can affect mortgage applications:

- Reported Salary: Lenders consider gross salary when assessing mortgage applications. Your post-exchange salary may appear lower, which could impact borrowing capacity.

- Proof of Income: It is important to provide lenders with your total gross salary (pre-exchange) details to avoid confusion.

- Consult with Lenders: Always check with potential lenders to understand how they treat Salary Exchange.

Will my student loan repayments be affected?

Yes, Salary Exchange can affect student loan repayments:

- Repayments are calculated based on gross salary before any Salary Exchange deductions. Therefore, your repayments should remain the same, but since the gross salary appears lower after Salary Exchange, this could potentially reduce the amount you repay.

Can I choose to opt in or out of salary exchange?

Yes, employees typically have the flexibility to opt in or out:

- Opting In: Employees can opt in by agreeing to the terms set by their employer, usually through a formal agreement.

- Opting Out: Employees can choose to opt out, but some employers may have specific rules regarding the frequency of changes or notice periods.

Will my take-home pay change with Salary Exchange?

Yes, your take-home pay could change with Salary Exchange:

- Potential Increase: In many cases, take-home pay can slightly increase due to reduced tax and NI contributions.

- Factors Influencing Change: The change depends on individual circumstances, such as the amount exchanged, tax bracket, and other deductions.

Will salary exchange affect other payments or benefits?

Salary Exchange may affect other payments or benefits:

- State Benefits: State benefits like Statutory Maternity Pay or State Pension might be impacted, as they are based on your earnings.

- Employer Benefits: Company benefits such as bonuses, overtime, and life cover might be calculated based on your new (lower) salary.

- Other Allowances: Allowances that depend on gross salary, such as childcare vouchers, might also be affected.

Get more now. Have more later.

We setup and manage your pensions, payroll, and salary exchange—all in one place, ensuring compliance every step of the way.

Related Post