- We conduct real-time assessments during every pay run to provide proof of compliance.

- We appeal fines from The Pensions Regulator and resolve compliance issues to avoid penalties.

- We backdate contributions to quickly fix non-compliance issues and restore compliance.

How it works?

Watch the video

to learn more

Pricing to suit business of all sizes

Less hassle and lower costs for you now and more benefits for your employees later.

50+

Employees

For organisations with over 50 employees, a customised and detailed approach is essential.

50+

Employees

For organisations with over 50 employees, a customised and detailed approach is essential.

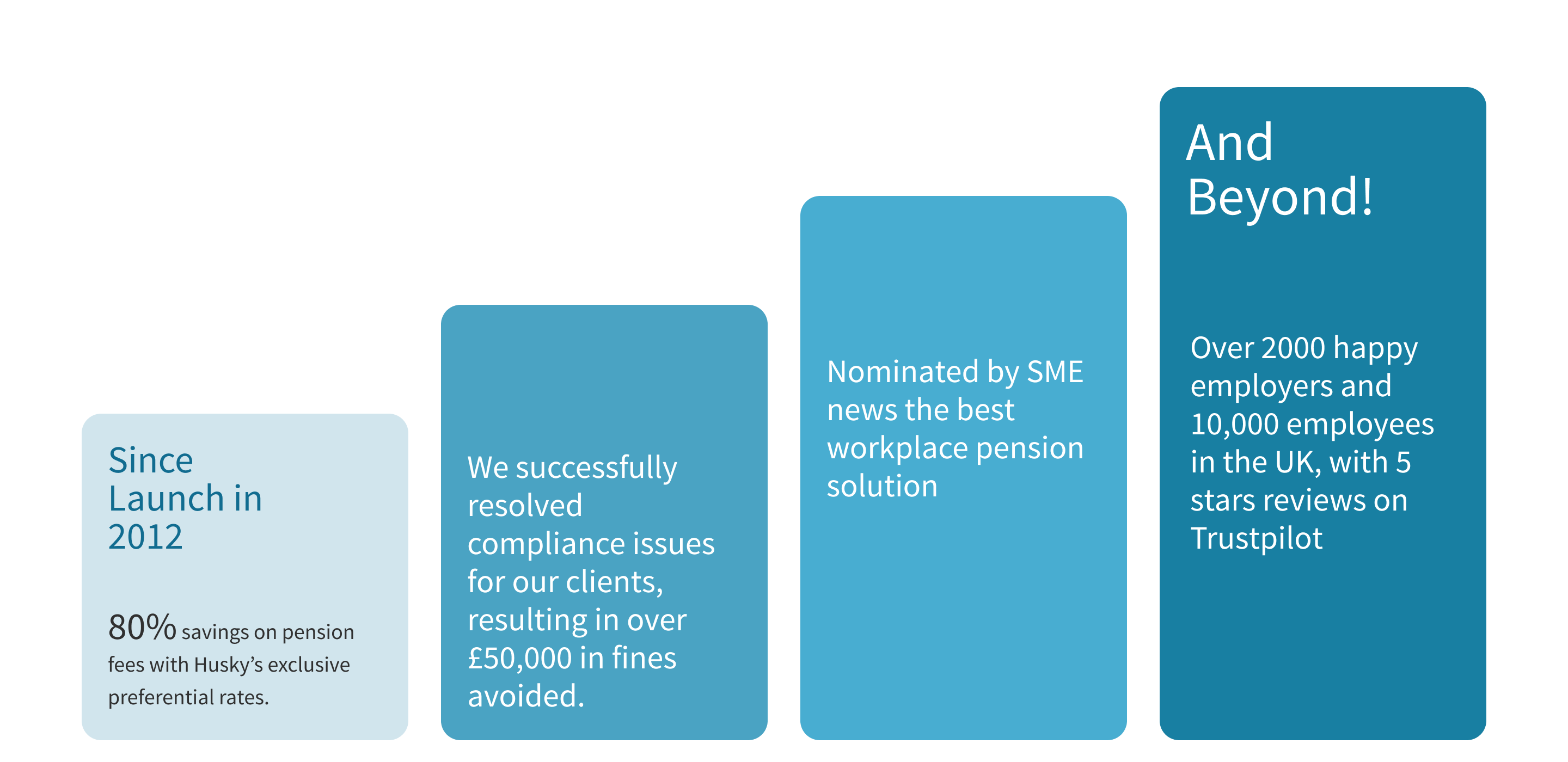

Over 2,000 employers save time and money with Husky.

EXCELLENTTrustindex verifies that the original source of the review is Google. Professional responsive service that works for our business needs. Reliable, transparent, honest company to work with. Highly recommend.Posted onTrustindex verifies that the original source of the review is Google. My business, Spalding Massage Therapy used Husky's services throughout our period of employing staff. From set up and registering with HMRC through to sadly the point where we have had to stop employing, Husky and our point of contact Olga have been so helpful & professional. Their fees for small businesses are very reasonable IMHO and the Helpdesk has been relentlessly supportive - even when Olga had to explain the same thing to me 3 months running!Posted onTrustindex verifies that the original source of the review is Google. When time was of the essence Husky pulled our very new to the world of employment out of the waters. They were fast acting, professional and explained everything in a way that just melted all the anxiety of payroll and pensions away. The team are friendly and relatable, while being efficient and professional. We couldn't have asked for more, (a quick mention that Steve from payroll has been especially helpful and has gone above and beyond to explain any queries)Posted onTrustindex verifies that the original source of the review is Google. A very professional, efficient, trustworthy, reliable payroll and pension roll service provider that are competitively priced. Earl Shilton Town Council hope to have a long and happy working relationship with Husky Finance colleagues.Posted onTrustindex verifies that the original source of the review is Google. I would highly recommend Husky finance, I use them for Pensions on a number of our Companies. Kay is a superstar, she has helped me no end, a true professional throughout. Thank you Kay and all the team at Husky.Posted onTrustindex verifies that the original source of the review is Google. Excellent friendly service to sort all the statutory auto enrollment requirements in the UK for Erris Resources plc and Erris Gold Resources Ltd.Posted onTrustindex verifies that the original source of the review is Google. Husky manage both our monthly payroll and pension needs. From the beginning, they have been incredibly supportive. Our Head Office is in Ireland, so having a team knowledgeable of the intricacies of UK payroll and pensions has been a life saver for us.Posted onTrustindex verifies that the original source of the review is Google. Makes workplace pensions so much easier and transparentPosted onTrustindex verifies that the original source of the review is Google. We are certainly not their largest client, but they treat us so well and offer such great customer service, that you would think we were the most important client to them. Everything about working with Husky was so easy. We are a US based non profit hiring our first employee in the UK, so naturally, we had lots of questions. The team at Husky (especially Nigel and Kay) walked us through all of our options and really helped us find the best solution. I'd definitely recommend them.Posted onTrustindex verifies that the original source of the review is Google. We have used the services of Huskey for over a year now, they look after our company pension scheme. The reason I chose Huskey was because from the moment I contacted them they were so helpful and everything they promised, they followed through. Nothing was too much work for them. I would definitely recommend them.

Gain some valuable insights

Could Your Business Face Fines for Pension Non-Compliance? Find Out!

Navigating Pension Compliance: Insights from the Pensions Regulator

Understanding the Pension Declaration of Compliance

If you’re an employer in the UK and hiring staff, it’s crucial to meet your legal obligations regarding workplace pensions. One key step is completing..

Award-winning solution

Common Compliance questions

If you have more questions you can always access our knowledge base on this link.

When should new employees be enrolled?

Employers must automatically enrol all new and eligible employees who are:

- aged 22 to state pension age

- earning over £10,000 a year

- Working or ordinarily work in the UK

- Not already part of a qualifying workplace pension scheme

Do I need to enrol overseas workers?

Working in the UK: If a worker works wholly in the UK, then they can be considered to be working in the UK. By working wholly in the UK, The Pensions Regulator means:

- the worker’s contract provides for the worker to be based at a location in the UK, and the worker does, in practice, work all the time in the UK, and

- there is no simultaneous employment relationship between the worker and an employer outside the UK (e.g. the worker is not someone who has been sent to the UK by an affiliated employer, for example on a secondment.)

Ordinarily working in the UK: Where a worker is not wholly working in the UK (the work they do is also done outside of the UK), it will need to be established if the worker ordinarily works in the UK.

In most cases, workers who fall into this category will be workers who do not have one fixed workplace (for example, they move around in their work). To decide if a worker ordinarily works in the UK, an employer needs to consider:

- If the worker is resident in the UK

- where the worker begins and ends their work

- where the worker's headquarters in

- whether they pay NI and or tax in the UK

- the currency they are paid in

- the worker's contract of employment

- seconded workers

More details can be found here.

If you have a worker that should be exempt from AE due to not working in the UK, please enter that into Husky's system so that the worker is not assessed for Auto-Enrolment.

What is the Duties Start date?

These duties apply immediately from the first day the first member of staff started working for them. This date is known as the Duties Start Date.

Working in the UK: If a worker works wholly in the UK, then they can be considered to be working in the UK. By working wholly in the UK, The Pensions Regulator means:

- the worker’s contract provides for the worker to be based at a location in the UK, and the worker does, in practice, work all the time in the UK, and

- there is no simultaneous employment relationship between the worker and an employer outside the UK (e.g. the worker is not someone who has been sent to the UK by an affiliated employer, for example on a secondment.)

Ordinarily working in the UK: Where a worker is not wholly working in the UK (the work they do is also done outside of the UK), it will need to be established if the worker ordinarily works in the UK.

In most cases, workers who fall into this category will be workers who do not have one fixed workplace (for example, they move around in their work). To decide if a worker ordinarily works in the UK, an employer needs to consider:

- If the worker is resident in the UK

- where the worker begins and ends their work

- where the worker's headquarters in

- whether they pay NI and or tax in the UK

- the currency they are paid in

- the worker's contract of employment

- seconded workers

More details can be found here.

If you have a worker that should be exempt from AE due to not working in the UK, please enter that into Husky's system so that the worker is not assessed for Auto-Enrolment.

Do AE regulations apply to employees currently in a SIPP?

Further, at the time of re-enrolment, the worker would need to be re-assessed and re-enrolled into a qualifying pension scheme if they meet the re-enrolment criteria, and then opt-out again before going into their present non-qualifying SIPP.

What are the minimum pension contributions?

From 6 April 2019 onwards, the minimum workplace pension contributions is a total of 8%, at least 3% of which must be paid by the employer. These minimums are required by the auto-enrolment legislation. The employee must contribute 5% but they may reduce their contribution if the employer decides to contribute more than the minimum.

What is Re-Enrolment?

Every 3 years from their staging date or duties start date, employers need to re-assess workers who have previously Opted out or elected to leave the workplace pension more than 1 year from the re-enrolment date. Any worker who meets the required assessment criteria for auto-enrolment then has to be re-enrolled in the pension scheme. These criteria are: age 22 up to the State Pension age earn at least £10,000 a year normally work in the UK (even if they often travel to other countries) Once the re-enrolment process has been completed, a Re-Declaration of Compliance should be filed with The Pensions Regulator within 5 months of the third anniversary of the staging/duties start date, whether or not new staff were added to the scheme.

Employers need to complete the Re-Declaration once the re-enrolment process is completed. Husky will complete the Re-Declaration on the company's behalf. When is Re-Enrolment happening? Husky will apply the three-year anniversary of the staging date or the last re-enrolment date as your re-enrolment date. The pay period that contains this re-enrolment date will be assessed to determine any re-enrolment requirements. You can select another date within three months from the re-enrolment date. Husky will contact you explaining the process and you can let us know if you would like to change your re-enrolment date.

What do you need to do? Husky’s auto enrolment platform will apply the re-enrolment requirements and ensure all applicable workers are correctly assessed for re-enrolment. You may wish to advise any workers who have previously Opted Out of the scheme that they may be re-assessed, however, any worker that is to be re-enrolled will be issued with re-enrolment communication at the close of payroll. Your Payroll should also be advised that you will be applying re-enrolment on the date specified above.

If you have any queries please contact us at support@huskyfinance.com.

Can employees opt out before being enrolled?

No. An employer must enrol all eligible employees first so that the pension provider can provide them with all the necessary information and documentation. Only after being enrolled, employees can take the decision individually to opt out of the pension scheme. If a worker opts out within a month of being added to the scheme, the payment will be refunded.