Why Most SMEs in the UK Haven’t Implemented Salary Exchange Yet

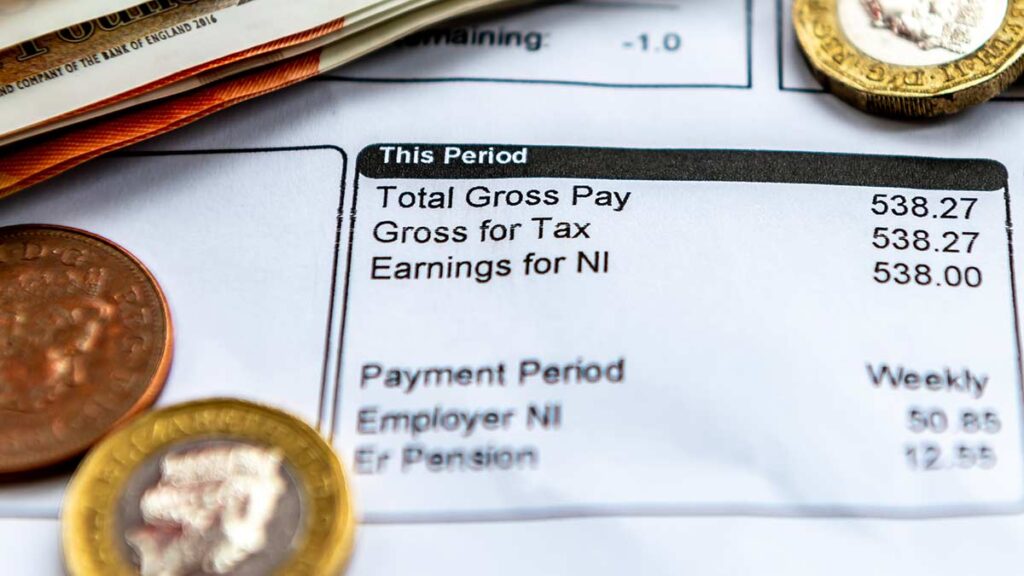

Salary Exchange (also known as Salary Sacrifice) is a different way of contributing to a workplace pension that allows both employers and employees to save on National Insurance contributions. This method increases take-home pay for employees and enhances cash savings for businesses, creating a win-win situation for everyone involved.

Despite its clear benefits, many Small and Medium Enterprises (SMEs) in the UK have not adopted Salary Exchange. Here are the key reasons why:

1. Limited Awareness and Understanding of Salary Exchange

Many SME owners and managers are simply not aware of Salary Exchange or do not fully understand how it works. Without clear, accessible information, they may overlook this valuable opportunity to improve financial outcomes for both their business and their employees. Misunderstandings about the process and its benefits can prevent companies from exploring its potential.

2. Perceived Administrative Burdens

Implementing Salary Exchange is often seen as an additional administrative burden. SME owners, who frequently wear multiple hats, may be deterred by the perceived complexity of adjusting payroll systems and handling the required documentation. This apprehension is compounded by the fear of potential compliance issues and the need to stay updated with changing regulations.

3. Financial Constraints

SMEs often operate with tight budgets and limited financial resources. The initial costs of setting up a Salary Exchange scheme, including potential fees for financial advice or software upgrades, can be a significant barrier. Many SMEs might prioritise immediate financial needs over long-term savings, thereby delaying or entirely forgoing the adoption of Salary Exchange.

4. Employee Engagement Challenges

Successfully implementing Salary Exchange requires effective communication and engagement with employees. Employers need to explain the benefits clearly and address any concerns employees might have. Also lack of pensions expertise on how to change the pension scheme settings and administration.

5. Technological Barriers

Updating payroll systems to accommodate Salary Exchange can require technological investments that SMEs might find daunting. Legacy systems may not support the necessary changes, and upgrading or replacing them can be both time-consuming and costly. The fear of disrupting existing payroll processes can also deter SMEs from implementing Salary Exchange.

Conclusion

While Salary Exchange offers clear financial benefits, several barriers prevent its widespread adoption among SMEs in the UK. By increasing awareness, simplifying administrative processes, addressing financial concerns, enhancing employee engagement, and overcoming technological challenges, more SMEs could take advantage of this beneficial scheme. The long-term savings and improved financial health for both businesses and employees make it a worthwhile consideration for any SME.

You can watch this video where David Painter, head of financial planning at Moore Kingston Smith, one of the biggest UK accountancy firms, reveals the reasons why 95% of SMEs in the UK haven’t implemented Salary Exchange yet, potentially missing out on significant financial benefits.

Calculate Your Savings

Despite these challenges, the potential savings are significant. Companies and employees can save thousands of pounds each year through Salary Exchange. These savings can offset the costs of implementation and even cover service fees, making it a financially sound decision in the long run.

You can use our calculator here and book a demo so we can explain how we can help your company with the implementation: https://huskyfinance.com/services/salary-exchange/

How Husky overcomes these challenges for SMEs.

Husky has successfully implemented Salary Exchange for over 2,000 employers, helping them save time and money.

Husky’s technology enables the entire process to be quick and automated through an app-based system. Husky handles the administration and engagement, and registration takes only 2 minutes.

Related Post