Salary Sacrifice: Transforming HR in 2025

As the workforce landscape continues to evolve, HR professionals face growing challenges to deliver benefits that are cost-effective, competitive, and engaging. Salary sacrifice—a tax-efficient method to enhance workplace pensions and other benefits—is proving to be a game-changer for HR teams in 2025.

What is Salary Exchange?

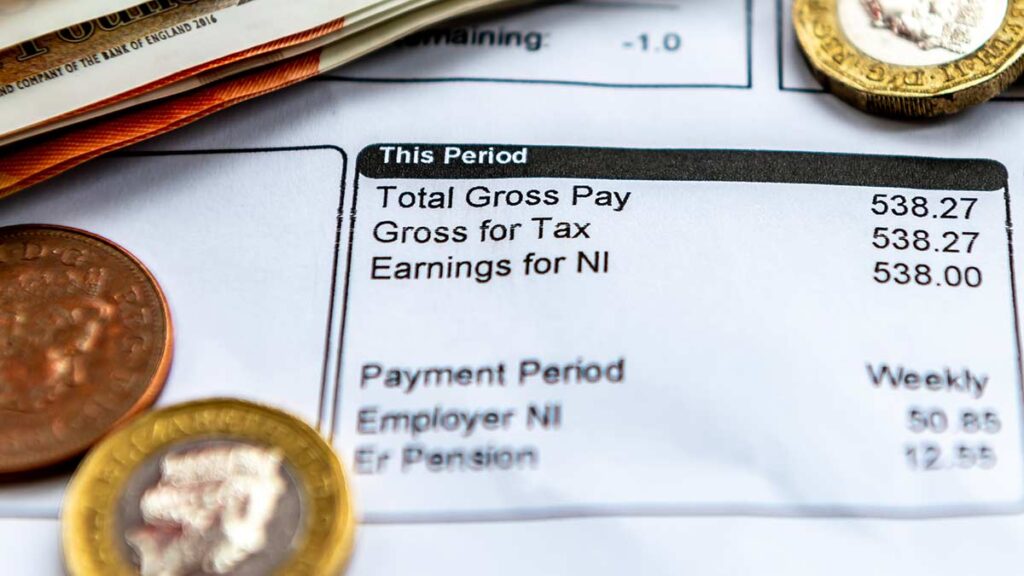

Salary exchange, also known as salary sacrifice, is a simple agreement where employees opt to reduce their gross salary in exchange for increased employer contributions to their pension or other benefits.

Key Benefits

For Employees: Reduced income tax and National Insurance contributions (NICs), resulting in higher take-home pay and potentially larger pension contributions.

For Employers: Lower NIC costs and improved employee satisfaction.

How Does It Work?

- Employees agree to a reduction in their gross salary.

- The employer reallocates the reduced salary toward pension contributions or other benefits.

- For instance, a UK employee earning £40,000 annually could save approximately £300 on NICs, while their employer saves around £450.

Why HR Teams Should Embrace Salary Exchange

- Enhanced Employee Benefits Salary exchange allows employees to boost their pension contributions without increasing personal outlay.

- Attracting and Retaining Top Talent In today’s competitive labour market, innovative benefits like salary exchange can set your organisation apart. Over 75% of UK employees consider workplace benefits a key factor when choosing an employer.

- Cost Savings for Employers By saving on NICs, employers can reinvest in their workforce or other business operations. On average, UK businesses implementing salary exchange save around £150 per employee annually.

- Alignment with ESG Goals Promoting financial well-being through salary exchange aligns with corporate social responsibility and sustainability objectives.

- Adapting to April’s Rising Payroll Costs With the Employer NI Rate set to rise from 13.8% to 15% in April 2025, alongside a lowered NI threshold, businesses face sharply increased payroll costs. Implementing salary sacrifice can help mitigate these increases, reducing the impact of rising costs while offering additional benefits to employees.

How to Implement Salary Sacrifice

Introducing salary exchange doesn’t have to be complicated. Husky’s automated solutions simplify the process, ensuring smooth implementation and tangible savings for both employees and employers.

Future Trends in Salary Sacrifice

Greater Personalisation: Employees increasingly demand customised benefits packages. Salary sacrifice offers flexibility, making it a valuable component of tailored solutions.

Focus on Financial Well-Being: Salary sacrifice complements broader initiatives aimed at enhancing employees’ long-term financial security, aligning with organisational priorities.

Conclusion: A Strategic Move for HR in 2025

Salary sacrifice isn’t just a cost-saving measure; it’s a powerful strategy for delivering meaningful employee benefits, improving engagement, and achieving organisational goals. By adopting salary exchange, HR teams can position their organisations as employers of choice for 2025 and beyond.

Start Now

With Husky’s expert support, implementing salary sacrifice has never been easier. Automate the process, reduce costs, and unlock the potential of this innovative benefit for your workforce. Contact us to see how Husky can help you save time and money with Salary Sacrifice.

Related Post