SAVE TIME. SAVE MONEY

Pension setup and management

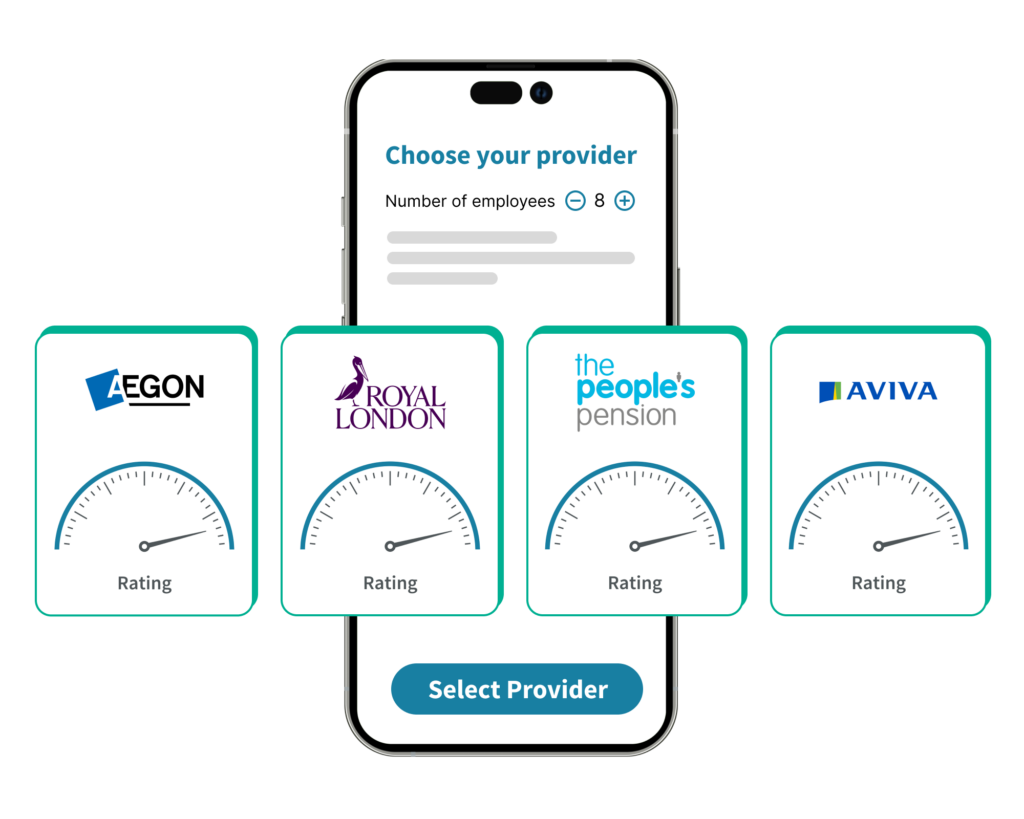

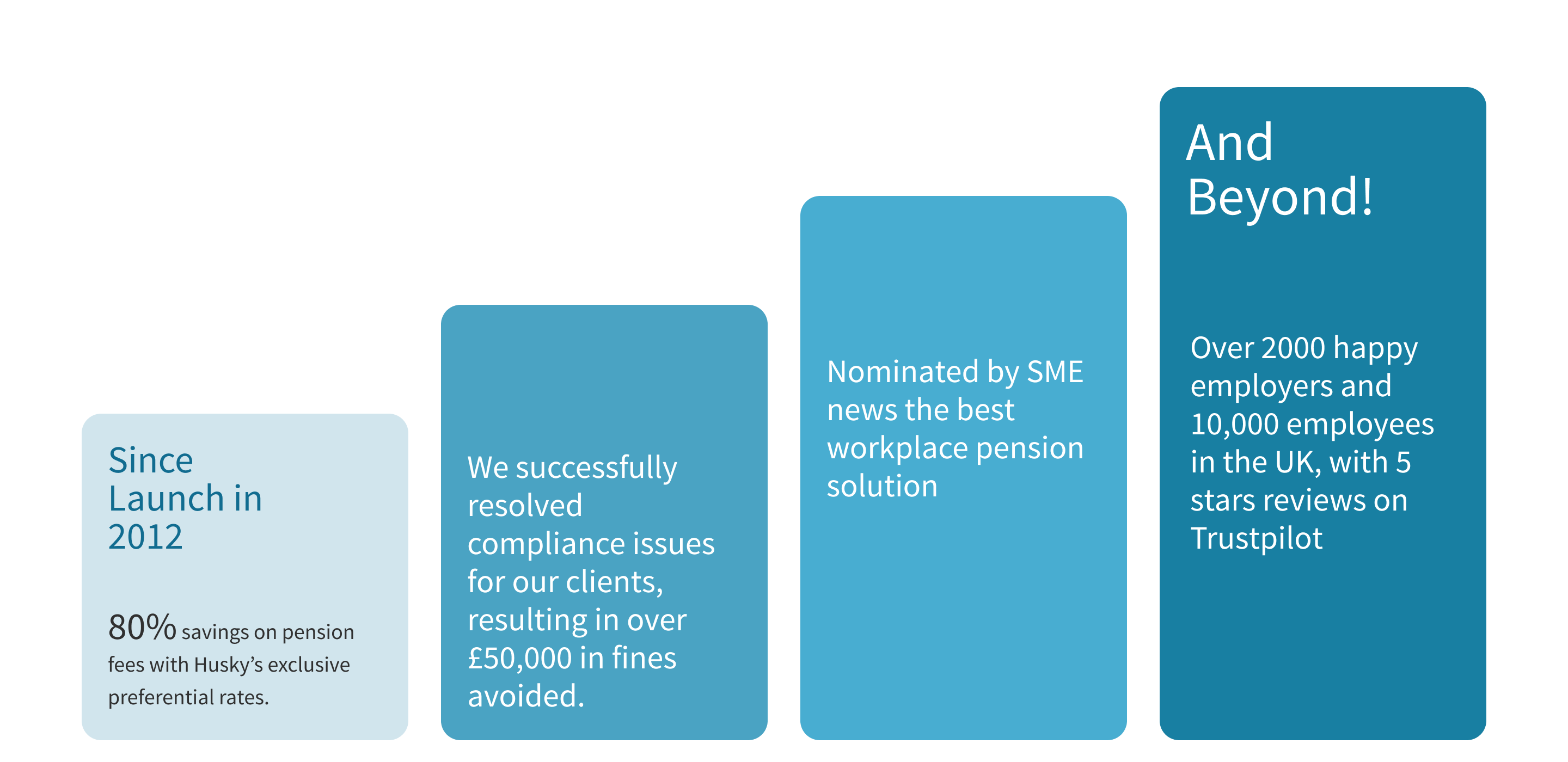

At Husky we deal with anything to do with workplace pensions for our clients, automating the entire process whilst ensuring compliance. With Husky, you gain access to preferential rates from the pension providers, potentially saving up to 80% on fees, and Husky sets it all up on your behalf.

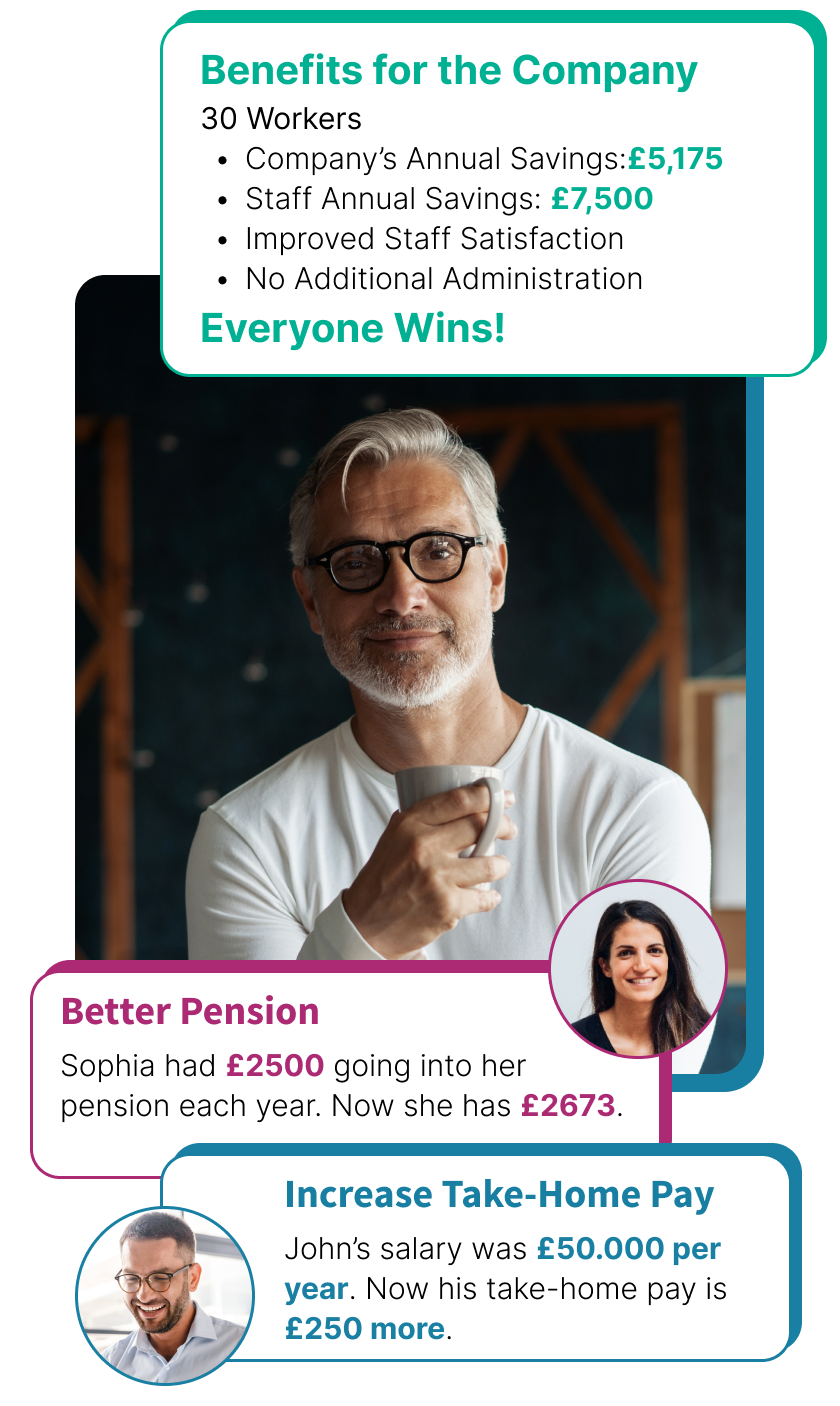

EVERYONE WINS

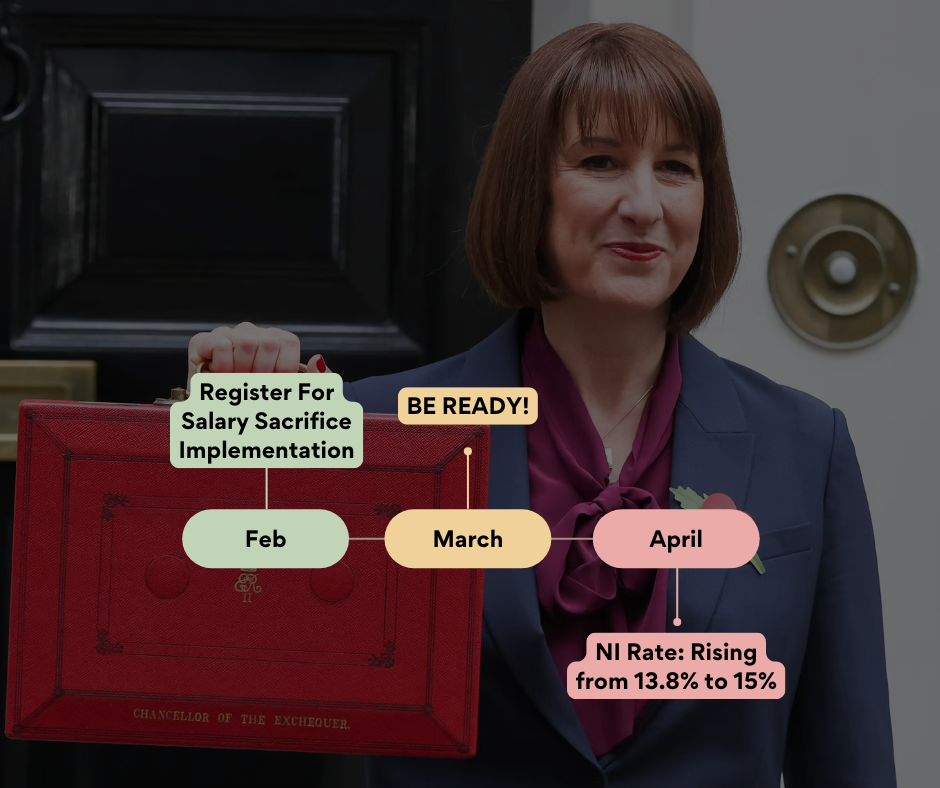

We unlock the benefits of Salary Exchange

It allows you and your employees to save on National Insurance contributions, putting more money in their pockets each month and increasing cash savings for your business.

These savings generated can cover Husky’s fees, creating a win-win situation for everyone involved.

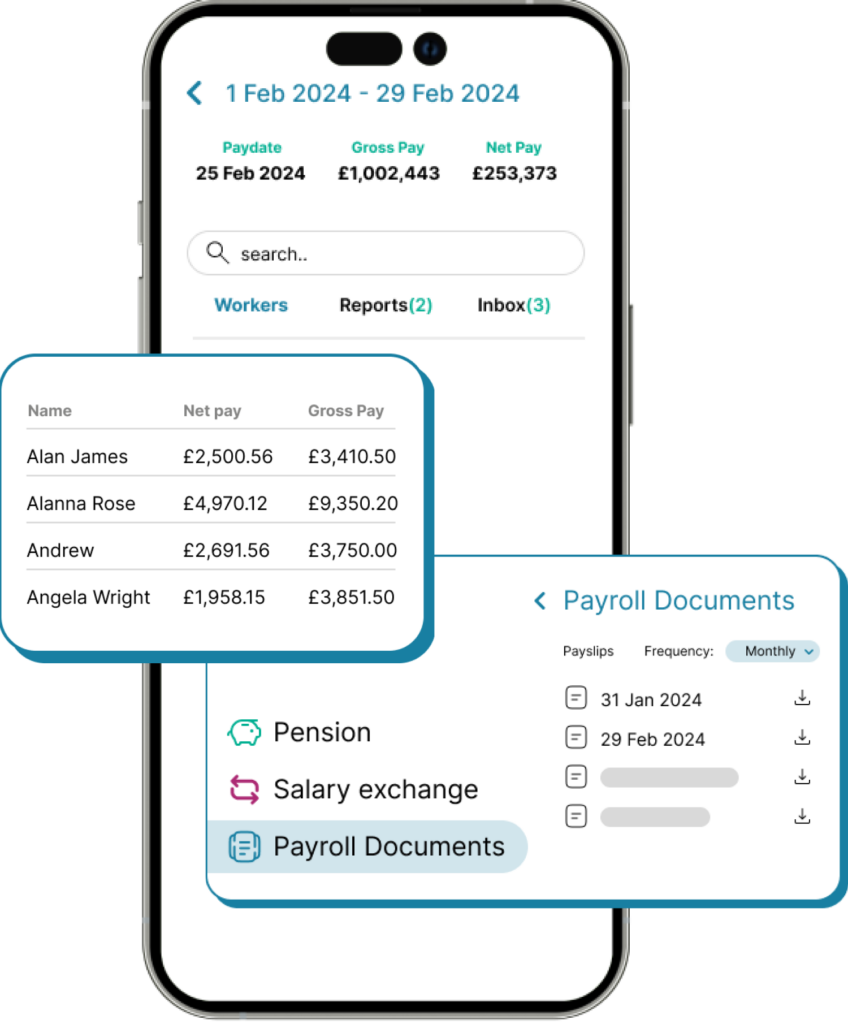

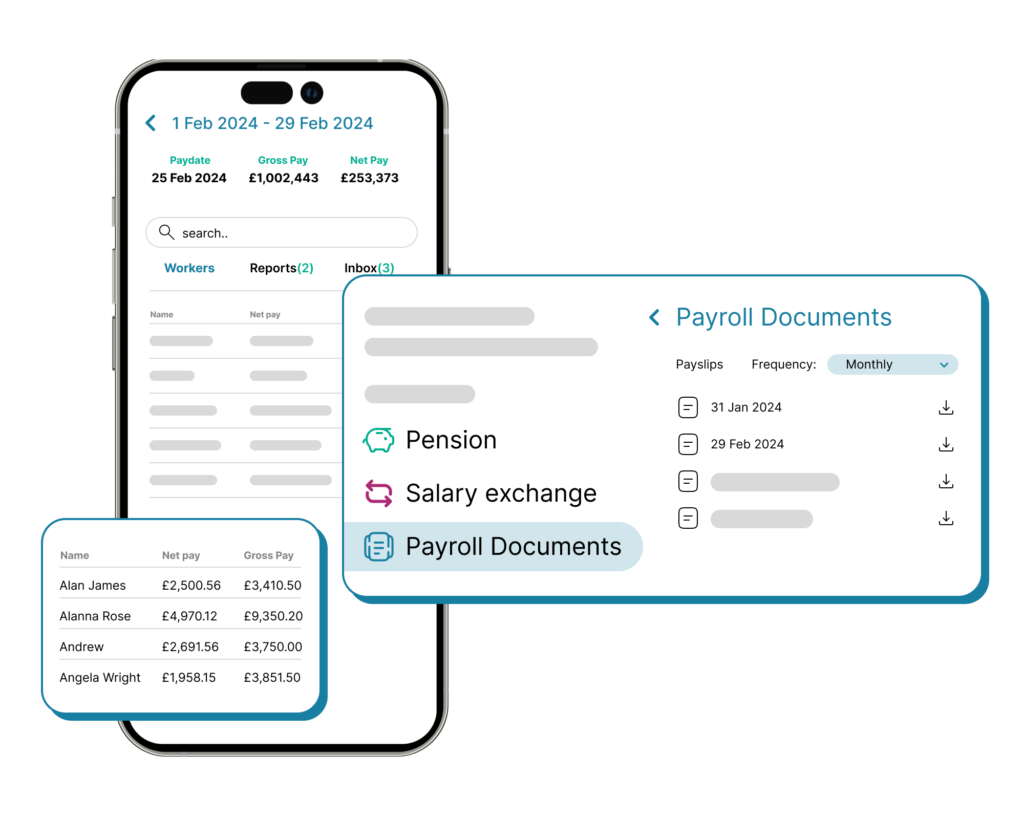

ALL IN ONE PLACE. DONE RIGHT.

Simplified payroll solutions

Husky seamlessly manages your payroll and integrates with your existing pension schemes, all while utilising Salary Exchange for added savings. Our user-friendly app automates the whole workflow saving you time and money, and ensuring maximum efficiency and compliance. All the management is available in the portal for the employer as well.

BE COMPLIANT. NOT CONFUSED

Compliance made easy

We ensure all auto-enrolment obligations are met, rectify any existing issues, and maintain full compliance for every employer. Even if you have compliance issues or have received a notice or fine from The Pensions Regulator, Husky can always help. With a proven track record of managing compliance for over 2,000 businesses, we’ve saved our clients more than £50,000 in fines, reducing hassle and costs while ensuring peace of mind for your business.

Watch this video for a deeper understanding of Husky.

EXCELLENTTrustindex verifies that the original source of the review is Google. Professional responsive service that works for our business needs. Reliable, transparent, honest company to work with. Highly recommend.Posted onTrustindex verifies that the original source of the review is Google. My business, Spalding Massage Therapy used Husky's services throughout our period of employing staff. From set up and registering with HMRC through to sadly the point where we have had to stop employing, Husky and our point of contact Olga have been so helpful & professional. Their fees for small businesses are very reasonable IMHO and the Helpdesk has been relentlessly supportive - even when Olga had to explain the same thing to me 3 months running!Posted onTrustindex verifies that the original source of the review is Google. When time was of the essence Husky pulled our very new to the world of employment out of the waters. They were fast acting, professional and explained everything in a way that just melted all the anxiety of payroll and pensions away. The team are friendly and relatable, while being efficient and professional. We couldn't have asked for more, (a quick mention that Steve from payroll has been especially helpful and has gone above and beyond to explain any queries)Posted onTrustindex verifies that the original source of the review is Google. A very professional, efficient, trustworthy, reliable payroll and pension roll service provider that are competitively priced. Earl Shilton Town Council hope to have a long and happy working relationship with Husky Finance colleagues.Posted onTrustindex verifies that the original source of the review is Google. I would highly recommend Husky finance, I use them for Pensions on a number of our Companies. Kay is a superstar, she has helped me no end, a true professional throughout. Thank you Kay and all the team at Husky.Posted onTrustindex verifies that the original source of the review is Google. Excellent friendly service to sort all the statutory auto enrollment requirements in the UK for Erris Resources plc and Erris Gold Resources Ltd.Posted onTrustindex verifies that the original source of the review is Google. Husky manage both our monthly payroll and pension needs. From the beginning, they have been incredibly supportive. Our Head Office is in Ireland, so having a team knowledgeable of the intricacies of UK payroll and pensions has been a life saver for us.Posted onTrustindex verifies that the original source of the review is Google. Makes workplace pensions so much easier and transparentPosted onTrustindex verifies that the original source of the review is Google. We are certainly not their largest client, but they treat us so well and offer such great customer service, that you would think we were the most important client to them. Everything about working with Husky was so easy. We are a US based non profit hiring our first employee in the UK, so naturally, we had lots of questions. The team at Husky (especially Nigel and Kay) walked us through all of our options and really helped us find the best solution. I'd definitely recommend them.Posted onTrustindex verifies that the original source of the review is Google. We have used the services of Huskey for over a year now, they look after our company pension scheme. The reason I chose Huskey was because from the moment I contacted them they were so helpful and everything they promised, they followed through. Nothing was too much work for them. I would definitely recommend them.

Over 2,000 employers save time and money with Husky.

Award-winning solution