Watch the video to discover how Salary Exchange can benefit your company, and book a call to get started.

The best part is there is no cost to you, the Salary Exchange savings cover the Husky service fee.

- Easy implementation

- Ensure compliance

- Husky is one of the only providers that can set up Salary Exchange schemes based on Qualifying Earnings

- No Independent Financial Advisor (IFA) costs are incurred when using Husky.

- Ongoing Support

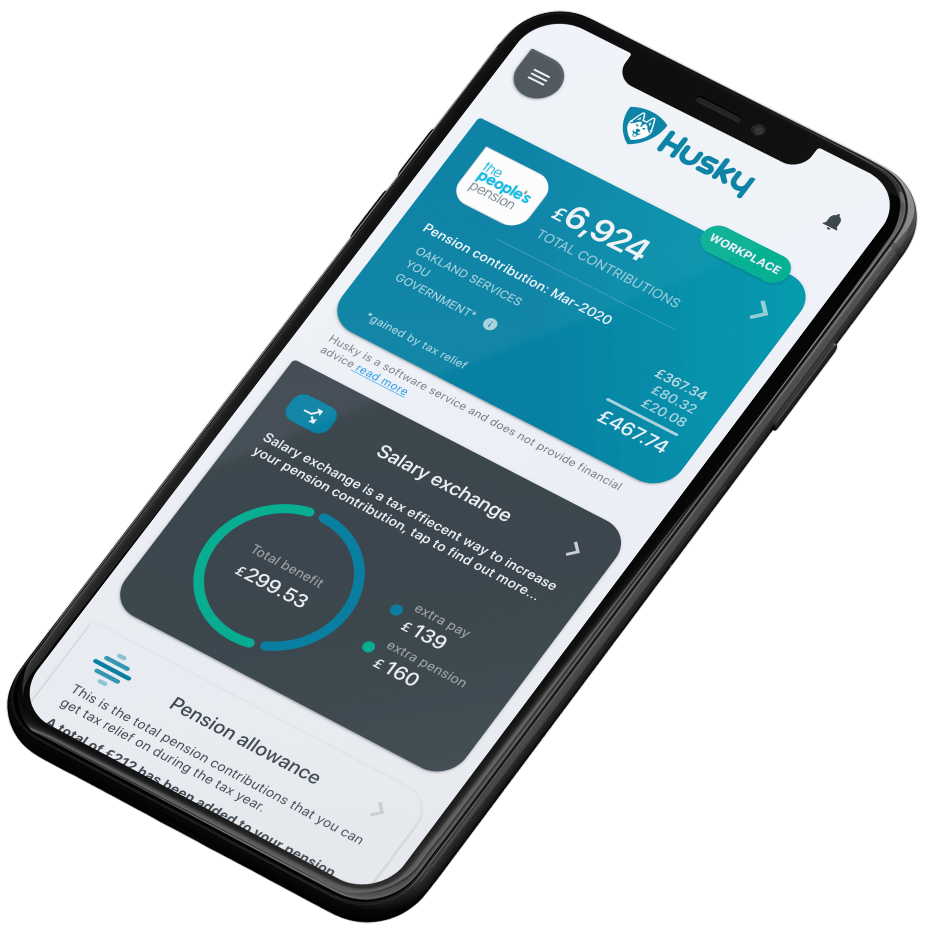

- Automation with Husky4Everyone App

More now later

We unlock the benefits

of Salary Exchange

We discovered that over 95% of small businesses are not benefiting from the Salary Exchange scheme. We handle the setup and management for you, so you don’t miss out on this valuable benefit.

Why setting up Salary Exchange is so crucial?

It allows you and your employees to save on National Insurance contributions, putting more money in their pockets each month and increasing cash savings for your business.

In short, everyone wins.

Advantages for Employers

Less hassle cost for you

More now later

Reduced tax and NICs

This cost-effective agreement reduces the employee’s annual salary. Income tax and NICs are then calculated on lower earnings, allowing you and your staff to keep more and save more.

Boosted business savings

Paying less NICs to your employee’s record means more business savings for you.

Boosted pension pot

You could boost your employee’s pot by adding your business savings to their pension. Salary Sacrifice becomes a valuable workplace benefit when employers boost their staff’s pensions.

Increased employee satisfaction

Salary Sacrifice is a zero-cost employee benefit. It increases employee satisfaction and retention.

Discover John and his employer's real-life savings journey

Before the switch to Salary Exchange:

- John’s gross annual salary: £35,000

- John’s annual pension contribution: £1,438

- Employer’s annual pension contribution: £862

- Total annual contributions: £2,300

With the switch to Salary Exchange:

Employer’s potential savings:

- Up to £198 on employer’s National Insurance

- Up to £273 on corporation tax

John’s potential benefits:

- Up to £173 more in his take-home pay

- Up to £198 more in his pension pot (depending on whether you, as the employer, reinvest all or part of the above National Insurance savings into the employee’s pension pot)

Default | After Exchange | Saved | |

|---|---|---|---|

Gross Salary | 35,000 | 33,562 | |

Income tax | -4,486 | -4,198 | |

Employee NIC | -2,692 | -2,519 | |

Take-home net pay | 26,672 | 26,844 | 173 |

Employer NIC | 3,574 | 3,376 | 198 |

Employee Pension Contribution | 1,438 | ||

Employer Pension Contribution | 862 | 2,300 | |

Total Pension contribution | 2,300 | 2,300 |

Salary exchange calculator

See how implementing salary exchange can positively benefit your company and workers

Our benefits over competitors

Easy implementation

Husky equips both the company and workers with all the information required for a thorough understanding of Salary Exchange. The Husky App automates contractual agreements based on worker requests, significantly reducing the time required to draft, prepare for signing, and communicate future changes.

Compliance

We'll take care of the setup, administration, and ensure compliance with our expert knowledge of the legislation.

Payroll Monthly Process

Husky provides payroll teams with the necessary changes for payroll settings based on established contracts, minimising administrative coordination efforts. And, we can even run your Payroll

See why employers

choose Husky.

Our Achievements

80%

savings on pension fees with Husky’s exclusive preferential rates.

2000+

businesses have saved money, streamlined admin and ensured compliance with Husky.

8000+

individuals have more control over retirement planning because their employers use Husky.

£50,000+

We successfully resolved compliance issues for our clients, resulting in over £50,000 in fines avoided.

Pricing to suit business of all sizes

When registering, you can opt for us to also handle your payroll, salary exchange, and compliance matters. Please note that selecting these services may result in pricing variations based on the size and complexity of your business. Rest assured, we will provide a pricing solution tailored to your specific needs.

50+

Employees

-

For organisations with over 50 employees, a customised and detailed approach is essential.

How to get started

Onboarding call

You can book a time with us here on this link to have an onboarding Salary Exchange Pension setup call so that we can explain how the Salary Exchange process works and discuss the timelines and team communications.

Delegate access

Husky will become your new pension administrator so we’ll need access to your existing pension scheme. You will let us know who your current pension provider is and we will send a simple guide on how to give us delegate access to the scheme.

Workforce onboarding

We will liaise with your payroll directly to onboard all your workers into the Husky system so we won’t need anything from your end.

Communicate with your employees

We will give you some draft communications to send to your staff to explain the benefit you are implementing and how can they apply from the Husky app.

Go live

Employees can now request and sign the agreement directly from the Husky app and the employer only has to accept it online. That’s it!

Have the financial experience you and your employees deserve.

Here are 7 frequently asked questions about Salary Exchange

If you have more questions you can always access our knowledge base on this link.

As the employee’s gross earnings are reduced, the employer also saves on their National Insurance Contributions (NIC).

Those savings can be re-invested into the employee’s workplace pension pot to provide an even better employee benefit and encourage them to join. With Husky, you can also split those savings into specific %s so you can share the savings between the company and the employee.

Salary Exchange is an agreement between the employee and the employer. The employee's contract of employment is altered to reflect that they have agreed to exchange part of their future gross salary or bonus entitlement in return for a non-cash benefit, such as an employer pension contribution.

What are the benefits of a Salary Exchange scheme?

- Employers save on NI contributions while employees can save on tax as well as NI contributions.

- Employers can reinvest any NIC savings in their business or their employees’ pension plans.

- Employees receive a higher pension contribution or take-home pay, depending on how the arrangement’s set up.

- Employees can benefit from a bigger retirement fund, if NIC savings are reinvested back into their plan.

Are there any possible drawbacks to a Salary Exchange scheme?

- Lower life cover (employers generally calculate entitlement as a multiple of salary which would be lower)

- Lower borrowing available on mortgages (as per life cover the borrowing level is determined by a multiple of a lower salary)

- Entitlement to state benefits eg Statutory Maternity Pay and the State Pension may be affected if your salary falls below the level at which you pay National Insurance contributions.

- The employee might not be able to revert to their old (pre-sacrifice) salary if personal circumstances change. The employer would have to agree to a further change to the employee's contract of employment.

Those savings can be re-invested into the employee’s workplace pension pot to provide an even better employee benefit and encourage them to join. With Husky, you can also split those savings into specific %s so you can share the savings between the company and the employee.

A salary exchange agreement can normally be altered, for example, if someone opts out of an automatic enrolment scheme with salary exchange.

For any other circumstances, it depends on how the agreement has been set up. It may be necessary to change the terms of a salary sacrifice arrangement where a lifestyle change significantly alters an employee’s financial circumstances.

This may include:

- changes to circumstances directly arising as a result of coronavirus (COVID-19)

- marriage

- divorce

- partner becoming redundant or pregnant

What are the benefits of a Salary Exchange scheme?

- Employers save on NI contributions while employees can save on tax as well as NI contributions.

- Employers can reinvest any NIC savings in their business or their employees’ pension plans.

- Employees receive a higher pension contribution or take-home pay, depending on how the arrangement’s set up.

- Employees can benefit from a bigger retirement fund, if NIC savings are reinvested back into their plan.

Are there any possible drawbacks to a Salary Exchange scheme?

- Lower life cover (employers generally calculate entitlement as a multiple of salary which would be lower)

- Lower borrowing available on mortgages (as per life cover the borrowing level is determined by a multiple of a lower salary)

- Entitlement to state benefits eg Statutory Maternity Pay and the State Pension may be affected if your salary falls below the level at which you pay National Insurance contributions.

- The employee might not be able to revert to their old (pre-sacrifice) salary if personal circumstances change. The employer would have to agree to a further change to the employee's contract of employment.

Those savings can be re-invested into the employee’s workplace pension pot to provide an even better employee benefit and encourage them to join. With Husky, you can also split those savings into specific %s so you can share the savings between the company and the employee.

You should speak to your tax credits office before you decide whether to participate in a Salary Exchange Scheme. You must also notify your tax credits office once you have exchanged your salary.

However, in broad terms, as your gross salary reduces (and employer pension contributions are disregarded) your entitlement to tax credits may increase. If you currently make personal contributions to a pension scheme, then you are currently entitled to deduct the gross amount of the pension contribution from your earnings to calculate your tax credits. In this situation, therefore, there should be little or no change to your tax credits entitlement.

Yes, salary exchange can be introduced into an existing plan as well as new plans.

Joining salary exchange is an employee’s choice and therefore an employee can not be forced to opt into a salary exchange (salary sacrifice) scheme.

Using salary exchange together with Auto-Enrolment means that if someone hasn’t signed the agreement they still need to be enrolled and therefore make their contributions as currently.

As an employer, you can have two sets of employees: one set in the scheme without Salary Exchange and contributing normally and the second in the scheme with Salary Exchange where the contributions are all made from the employer.

Some employers automatically include new employees in salary exchange (through their contract of employment) while allowing them to opt out of Salary Exchange if they wish.

Leaving a salary sacrifice exchange is always an option, and you should be able to do so without penalty if the arrangement isn’t working for you.

Your employer may have rules around when you can do this based on your salary exchange agreement, however they can’t make you stay in one. Your employer also cannot force you to enter into one.