It’s time to transform pensions into valuable assets

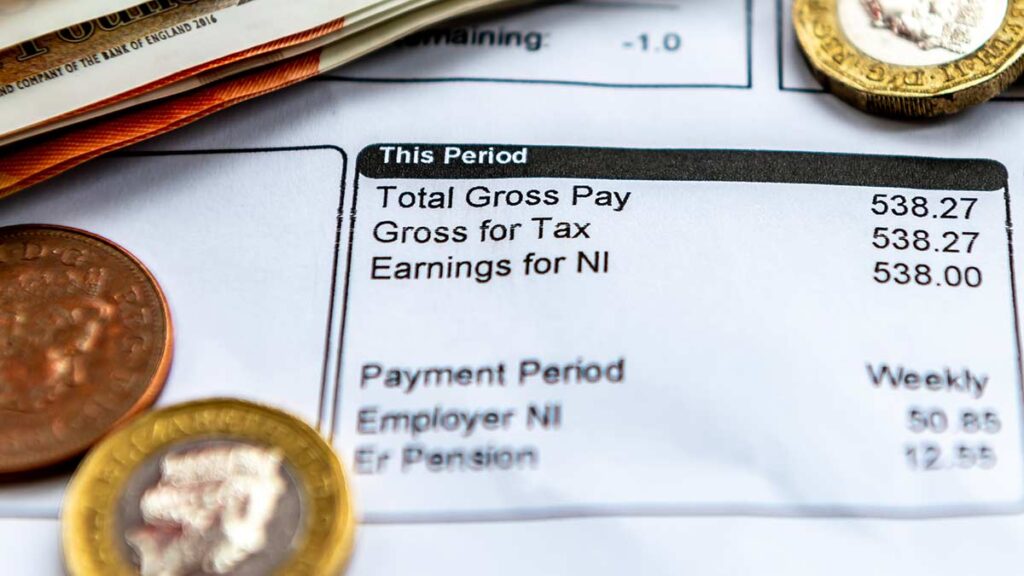

Offering competitive employee benefits is a powerful tool for attracting and retaining top talent. One often underestimated benefit is a well-structured pension plan. In the UK, auto-enrolment requirements mandate employers […]

It’s time to transform pensions into valuable assets Read More »