Husky Blog

Gain some valuable insights on how to be compliant, improve your pension benefits, and become an employer of choice.

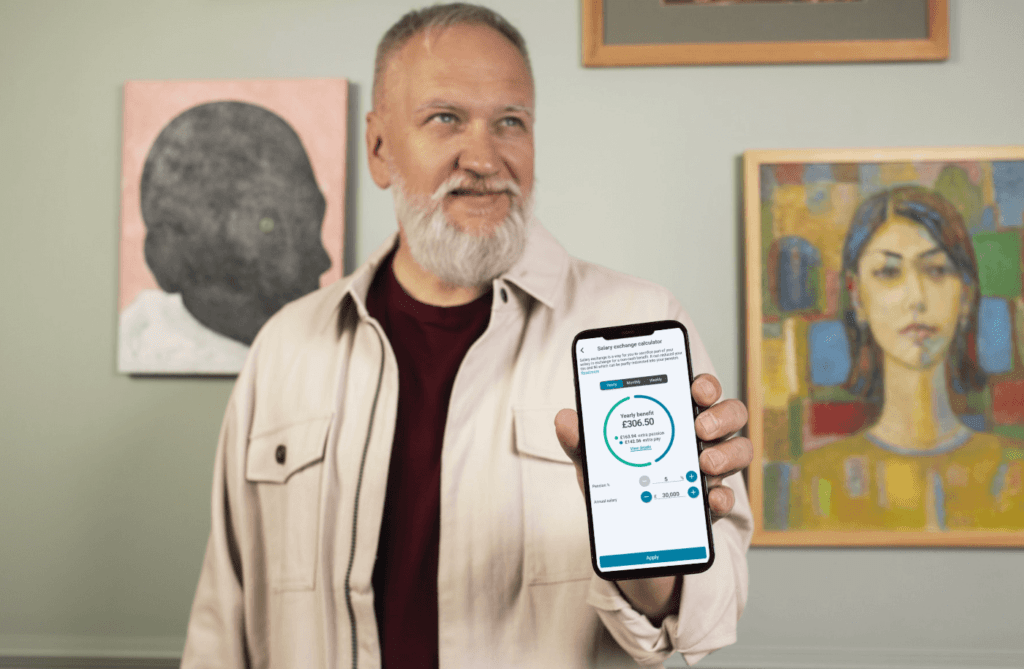

The Benefits of Salary Sacrifice

Salary Sacrifice or Salary Exchange is an arrangement between the employer and the employee, where the employee agrees to give up a portion of their..

What is a defined contribution pension?

A defined contribution pension is a type of private pension used in a workplace pension or a personal one. Private pensions can be defined benefit..

Employer pension contributions: how much should they pay into my pension?

Employers pay into your pension the set minimum contributions required by law, or more if they wish so. This requirement is set by the Government..

Salary Sacrifice examples and non-cash benefits

In a Salary Sacrifice scheme (or Salary Exchange), the employee agrees to give up part of their gross salary for a non-cash benefit. This scheme..

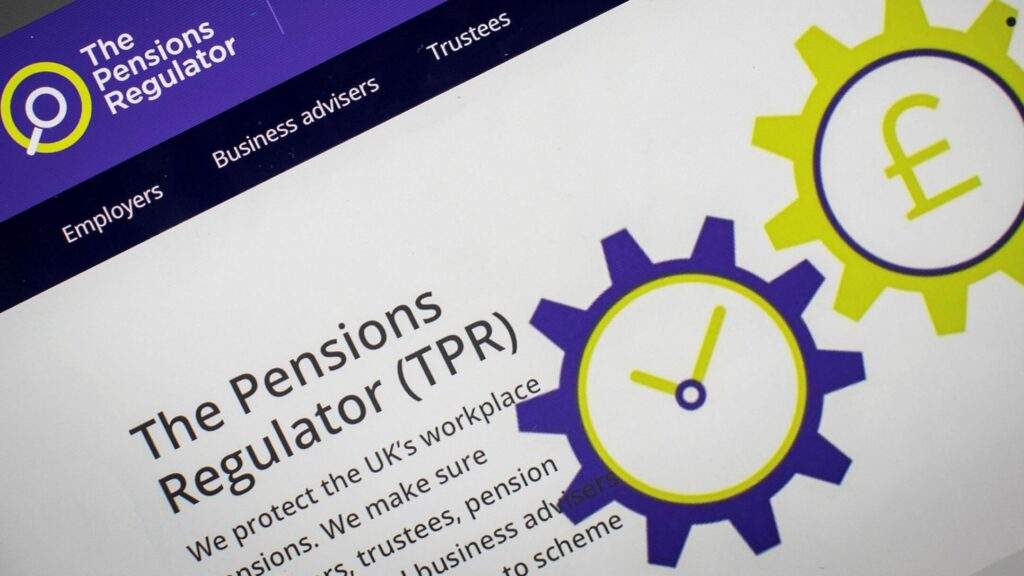

The Pensions Regulator targets suspect employers with on-site inspections

Under the Pension Act 2008, employers are required to auto-enrol their employees to a workplace pension scheme. The measures in the Act aim to encourage..